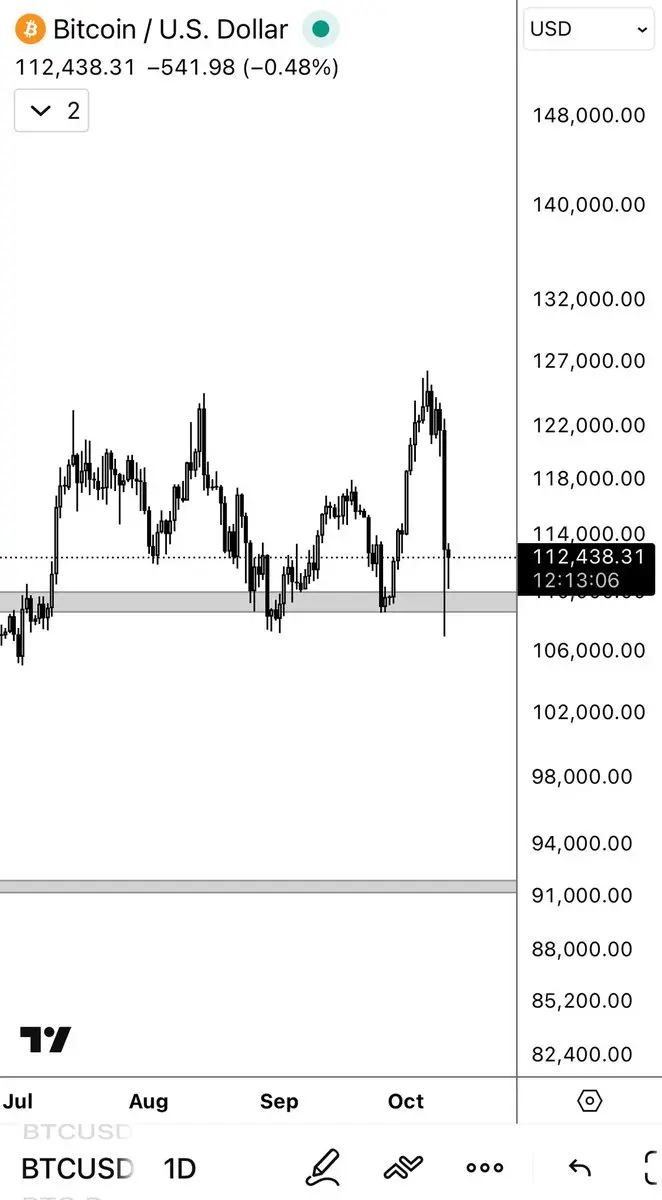

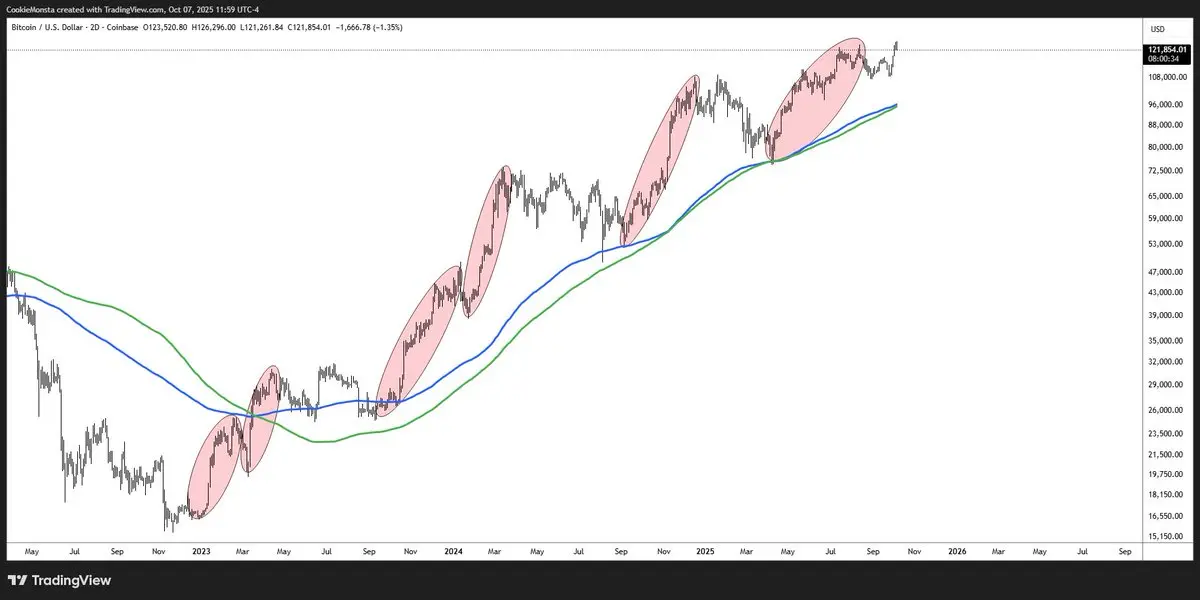

$BTC I'll make it clear:

- if it's a "Sweep of the Highs" - bulls lose some money

- if it's a "Higher-High" - bears miss out on one of only six rallies that have actually mattered in the past 3.5yrs

- if you called one of those six rallies a "Sweep of the highs", you have substantially less shekels to bet with, as a result of having missed out on the infrequent times where crypto has actually resembled a 'bullmarket'

- if you called the previous six rallies a "Higher-High", objectively, you have excessive house-money to play with, and would be enticed to repeat that behavior here today, regard