Gate Ventures Weekly Crypto Recap (October 20, 2025)

- Powell delivered a speech at the National Association for Business Economics, emphasising the dual-track strategy across rates and the balance sheet.

- This week’s incoming data includes the delayed release of US CPI, Chicago Fed national activity index, home sales data and UoM sentiment.

- BTC fell 5.49% and ETH declined 4.14%, weighed down by heavy ETF outflows (BTC -$1.23B, ETH -$311.8M). The Fear & Greed Index dropped to 29, signaling growing market caution, while ETH/BTC edged up 1.5% to 0.0364.

- Altcoins underperformed (-6.36%), as the Oct 11 liquidation event wiped out around $15B in long positions, forcing market makers to retreat and draining futures liquidity.

- The top 30 tokens dropped an average of 7.5%, with only Bittensor (TAO +3.9%) and Monero (XMR +1.7%) posting gains — TAO driven by its Dec 11 halving, and XMR by renewed privacy coin interest.

- ZEROBASE (ZBT): Real-time ZK prover network backed by Binance Labs and IDG Capital, launched at $0.322 (FDV $322M).

- LabTrade (LAB): Solana-based multi-chain trading protocol with Telegram integration, supported by OKX Ventures, GSR, and Gate Ventures, trading at $0.19 (FDV $193.6M).

- Tether open-sources Wallet Development Kit to power global self-custody infrastructure.

- MegaETH repurchases 4.75% equity and token warrants ahead of mainnet launch.

- Aurelion completes $134M Tether Gold purchase, becomes NASDAQ’s first tokenized gold treasury.

Macro Overview

Powell delivered a speech at the National Association for Business Economics, emphasising the dual-track strategy across rates and the balance sheet.

Fed Chair Jerome Powell delivered a relatively restrained speech before entering this month’s FOMC blackout period, stressing that the Fed faces a complex policy environment and must balance controlling inflation with supporting employment. Powell noted that although the government shutdown has led to gaps in some economic data, existing information indicates employment and inflation trends are similar to prior readings, and economic growth is slightly stronger than expected. However, there are signs of labor-market softening — slower hiring, fewer job openings, and a still-low unemployment rate. He acknowledged that there are “rising downside risks to employment”, which markets interpreted as potentially supporting another 25 bp rate cut this month.

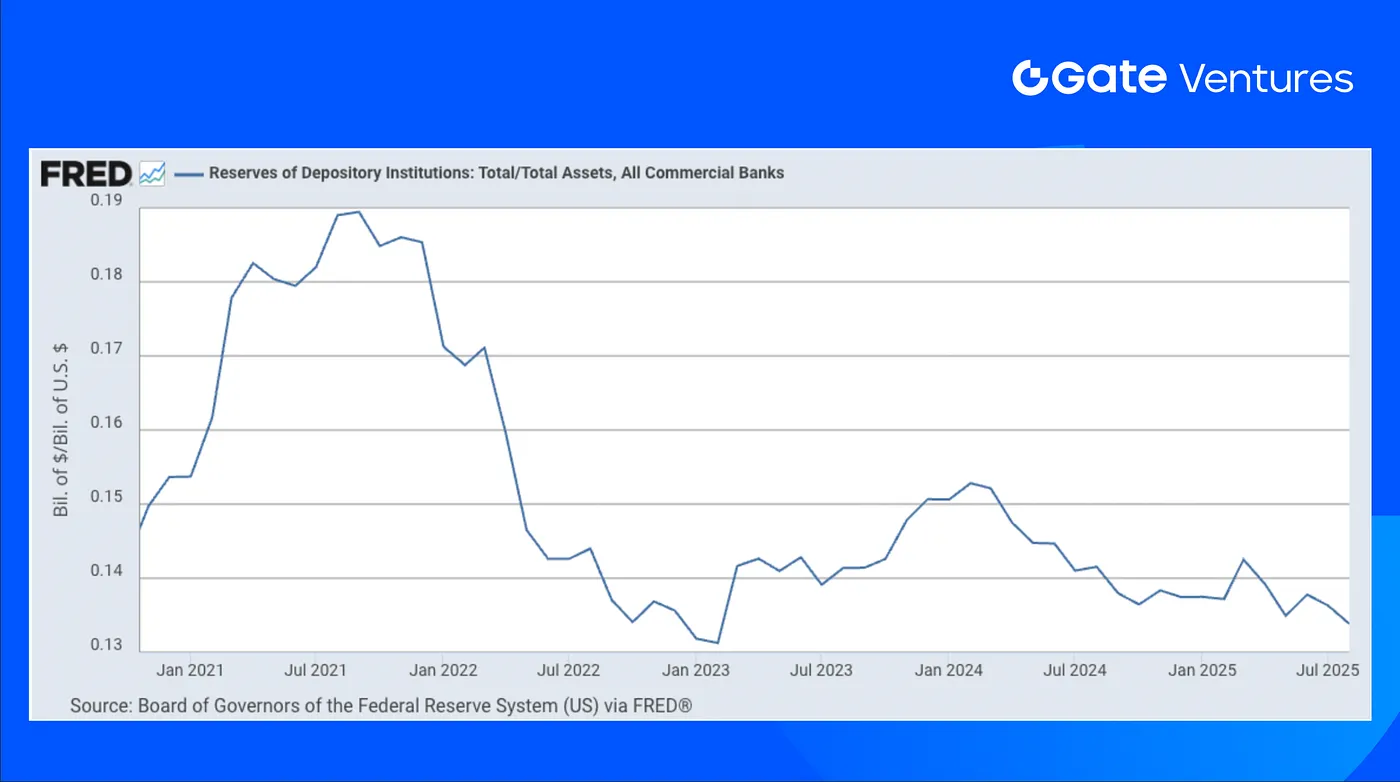

At the same time, Powell hinted the Fed may be close to stopping balance sheet tightening. Although banking reserves remain ample, rising repo rates indicate tightening liquidity. He emphasized avoiding a repeat of the sharp repo-market volatility in 2019. Stopping runoff would not only be a technical adjustment, but also a way to ease market strains by improving liquidity and reducing reliance on rate cuts. Powell’s remarks outlined a dual-track strategy across rates and the balance sheet. In the months ahead, the timing of rate cuts and an end to balance sheet tightening will be central market focuses.

This week’s incoming data includes the delayed release of US CPI on October 24th, US EIA crude oil stocks change, Chicago Fed national activity index, existing home sales, UoM sentiment and new home sales. Last week Zions and West Alliance Banks disclosed bad loans tied to illegal fraud, with over $60m assets to write-off. Such cases have raised the market fear on the credibility of regional banks and their holding assets, and further impacted the performance of US financial service sectors. (1, 2)

US Reserves of Depository Institutions as Percentage

DXY

The US dollar was set for weekly loss after the investors felt unease about the stability of dollar-linked assets, the uncertainties in the US macroeconomics and US regional banks’ credit crisis. (3)

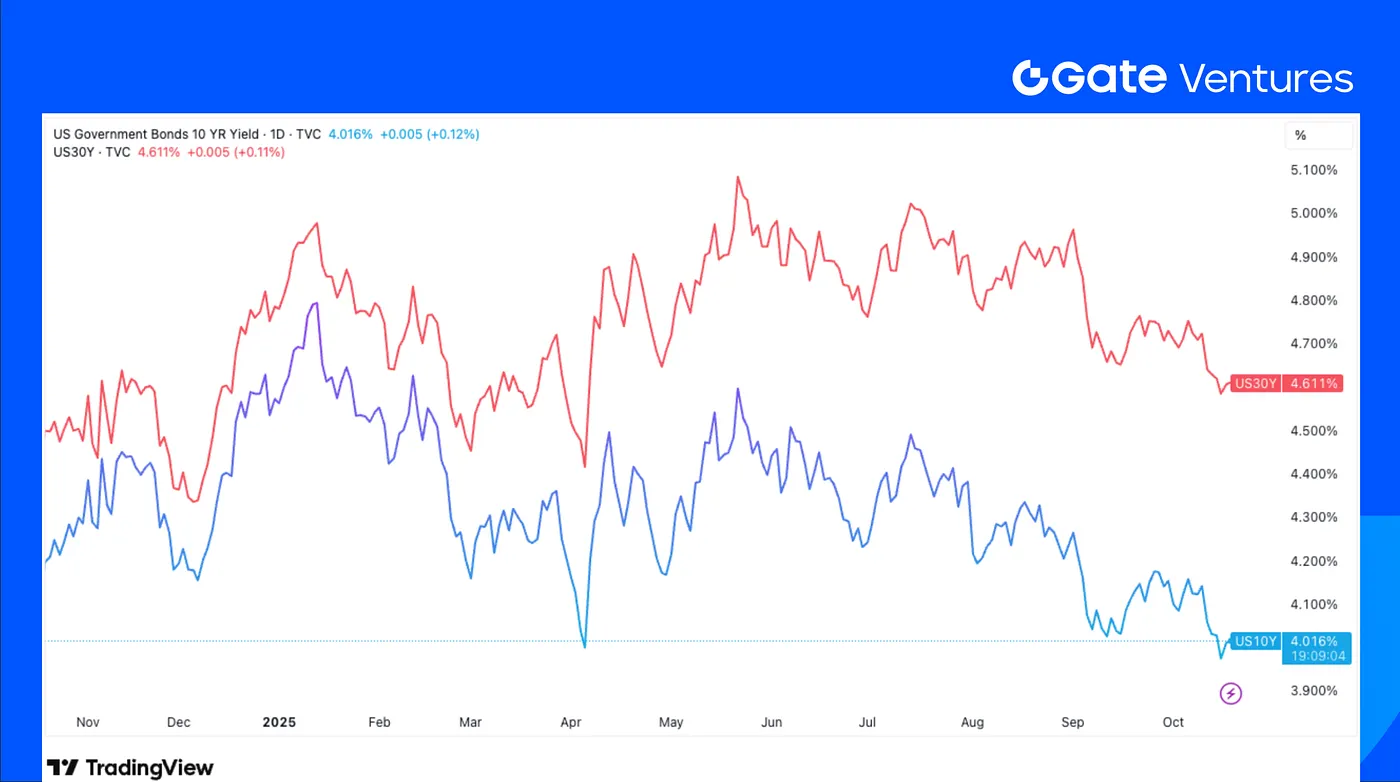

US 10-Year and 30-Year Bond Yields

The US short and long term bond yields have both followed the downward trend, and the 10-year bond yield has reached the lowest figure in the past 12 months. The weaker-than-expected economic survey result in the Philadelphia region, combined with trade tensions and the ongoing U.S. government shutdown accelerated that process. (4)

Gold

Gold prices have surged above $4,300 for the first time last week, despite a quick sell-off on Friday to bring the price back to $4,200 levels. The tariff turmoil, continuing US government shutdown and fear for regional bank credit crisis contributed to that. (5)

Crypto Markets Overview

1. Main Assets

ETH/BTC Ratio

BTC fell 5.49% over the past week, while ETH declined 4.14%. The drop in BTC’s price was linked to substantial ETF outflows, with BTC ETFs seeing net redemptions of $1.23B and ETH ETFs recording $311.8M in outflows. (6)

The Fear & Greed Index further retreated to 29, indicating deepening market caution. Meanwhile, the ETH/BTC ratio edged up 1.5% to 0.0364, suggesting a slight relative strength in ETH. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The overall crypto market cap fell 5.67% over the past week, while excluding BTC and ETH it dropped 5.58%. Altcoins underperformed, sliding 6.36%, as many market makers suffered heavy losses from the October 11th liquidation event and are unlikely to return in the near term. The $15B in long position liquidations also drained a significant amount of capital from futures markets, further reducing short-term market liquidity and participation.

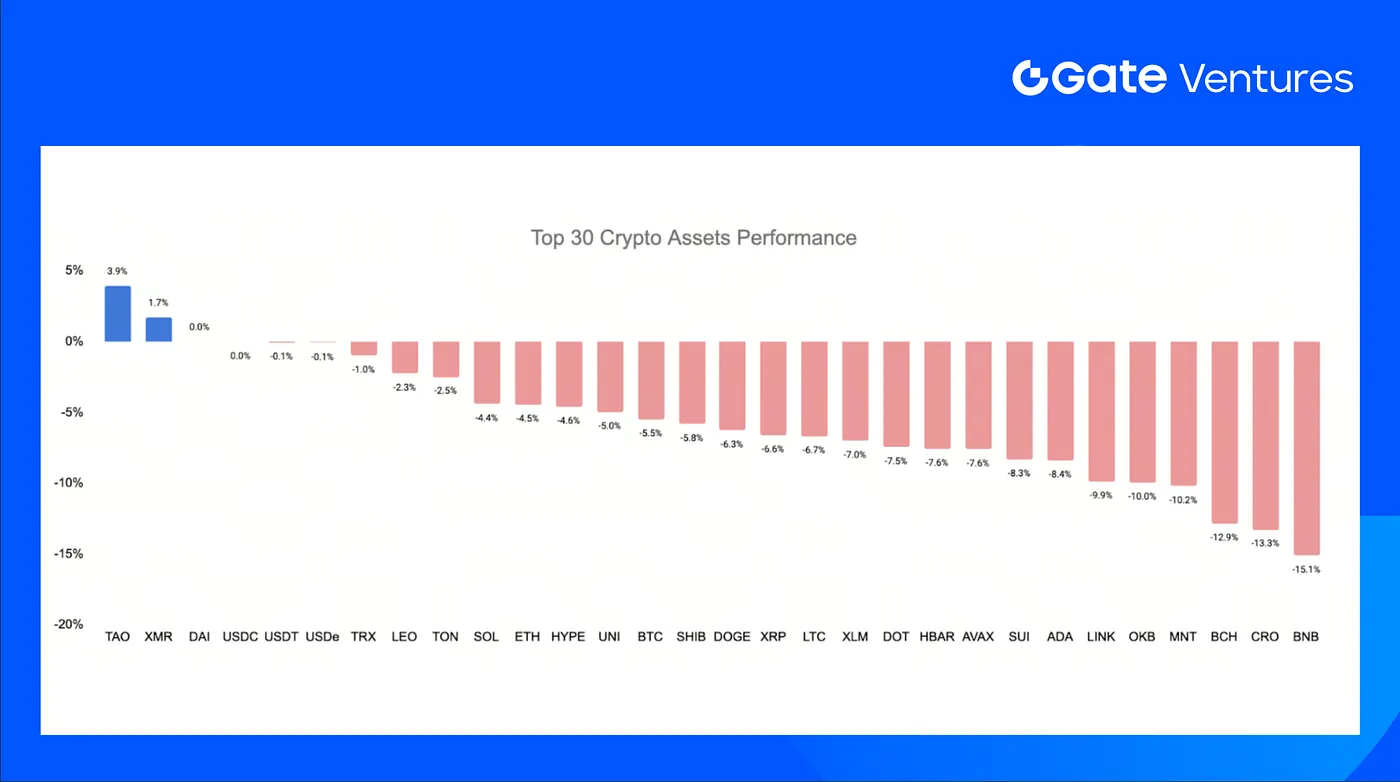

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Oct 20th 2025

The top 30 crypto assets dropped by an average of 7.5% last week, with only Bittensor (TAO) and Monero (XMR) posting modest gains.

TAO rose 3.9%, fueled by anticipation of its December 11 halving and the strong “subnet wealth effect.” XMR gained 1.7%, supported by the continuous interest in the privacy coin narrative from Western community. (8)

4. New Token Launched

ZEROBASE (ZBT) is a real-time ZK prover network that raised $5 million in a seed round , backed by investors including Binance Labs, IDG Capital,etc . The ZBT token launched with 22% initial circulating supply and is trading on major exchanges including Binance, Bybit, and Upbit. Current trading price is $0.322, implying a fully diluted valuation of $322M based on a 1 billion total supply.

LabTrade (LAB) is a multi-chain trading infrastructure protocol built on Solana, offering overlay applications and Telegram integration for sub-second execution and low fees. The LAB token is currently trading at $0.19, implying a fully diluted valuation of $193.6 million based on a 1 billion total supply. The project has raised $5 million backed by prominent VCs including OKX Ventures, GSR, and Gate Ventures, and is listed on major exchanges including Binance Alpha, Gate, and Bitget.

The Key Crypto Highlights

1. Tether open-sources Wallet Development Kit to power global self-custody infrastructure

Tether has open-sourced its Wallet Development Kit (WDK), a modular framework enabling developers, institutions, and AI agents to build multi-chain, self-custodial wallets across Bitcoin, Lightning, EVM, and non-EVM networks. The toolkit supports DeFi, payments, and asset management while integrating USDT, scaling technology for cross-chain liquidity. By eliminating vendor lock-ins and licensing fees, WDK positions Tether as a key enabler of financial sovereignty and programmable money infrastructure for both human users and autonomous digital systems. (9)

2. MegaETH repurchases 4.75% equity and token warrants ahead of mainnet launch

MegaETH, the high-speed Ethereum Layer 2 network, repurchased 4.75% of equity and token warrants from pre-seed investors ahead of its mainnet and token launch. The buyback, approved by Dragonfly and Echo, was executed above the prior seed valuation, when MegaETH raised $20M at a nine-figure token valuation. The move aims to tighten ownership alignment and remove secondary market circulation, reinforcing MegaETH’s focus on long-term builders as it prepares for a public sale via Sonar later this month. (10)

3. Aurelion completes $134M Tether Gold purchase, becomes NASDAQ’s first tokenized gold treasury

Prestige Wealth has completed a $134M purchase of Tether Gold (XAU₮) at an average price of $4,021.81, marking NASDAQ’s first tokenized gold treasury. Following its rebrand to Aurelion Inc., the company will operate under ticker AURE, with Antalpha (NASDAQ: ANTA) as controlling shareholder after a $150M financing round. Aurelion aims to merge the stability of physical gold with blockchain transparency and yield generation, establishing a regulated model for on-chain treasury management. (11)

Key Ventures Deals

1. Daylight raises $75M led by Framework Ventures and Turtle Hill Capital to scale decentralized home energy network

Daylight raised $75M, $15M in equity led by Framework Ventures with a16z crypto, Lerer Hippeau, M13, Room40 Ventures, and EV3, plus a $60M project facility led by Turtle Hill Capital, to expand its decentralized solar and storage network. The company offers subscription-based home energy systems with no upfront cost and integrates DayFi, a yield protocol linking DeFi capital to electricity revenues. Daylight’s model aligns community ownership, onchain rewards, and sustainable yield within the growing clean energy market. (12)

2. Inference secures $11.8M to scale privacy-preserving AI infrastructure for enterprises

Inference raised $11.8M in a seed round led by Multicoin Capital and a16z CSX, with Topology Ventures, Founders, Inc., and angels participating. The startup builds task-specific AI models that outperform general-purpose systems at up to 90% lower cost. Its models, up to 100× smaller than GPT-class architectures, allow companies to run faster, cheaper, and privacy-preserving workloads on their own infrastructure; positioning Inference as a key enabler of the emerging specialized-model economy. (13)

3. Tempo secures $500M Series A at $5B valuation to build high-throughput stablecoin infrastructure

Tempo, a payments-focused blockchain incubated by Stripe and Paradigm, raised $500M in a Series A led by Thrive Capital and Greenoaks, with Sequoia Capital, Ribbit Capital, and SV Angel joining. Valued at $5B, Tempo positions itself as an Ethereum-compatible Layer 1 for high-throughput payments and real-world settlement. The network already partners with OpenAI, Shopify, Visa, Anthropic, and Deutsche Bank, underscoring Stripe’s expanding ambitions in blockchain-based financial infrastructure. (14)

Ventures Market Metrics

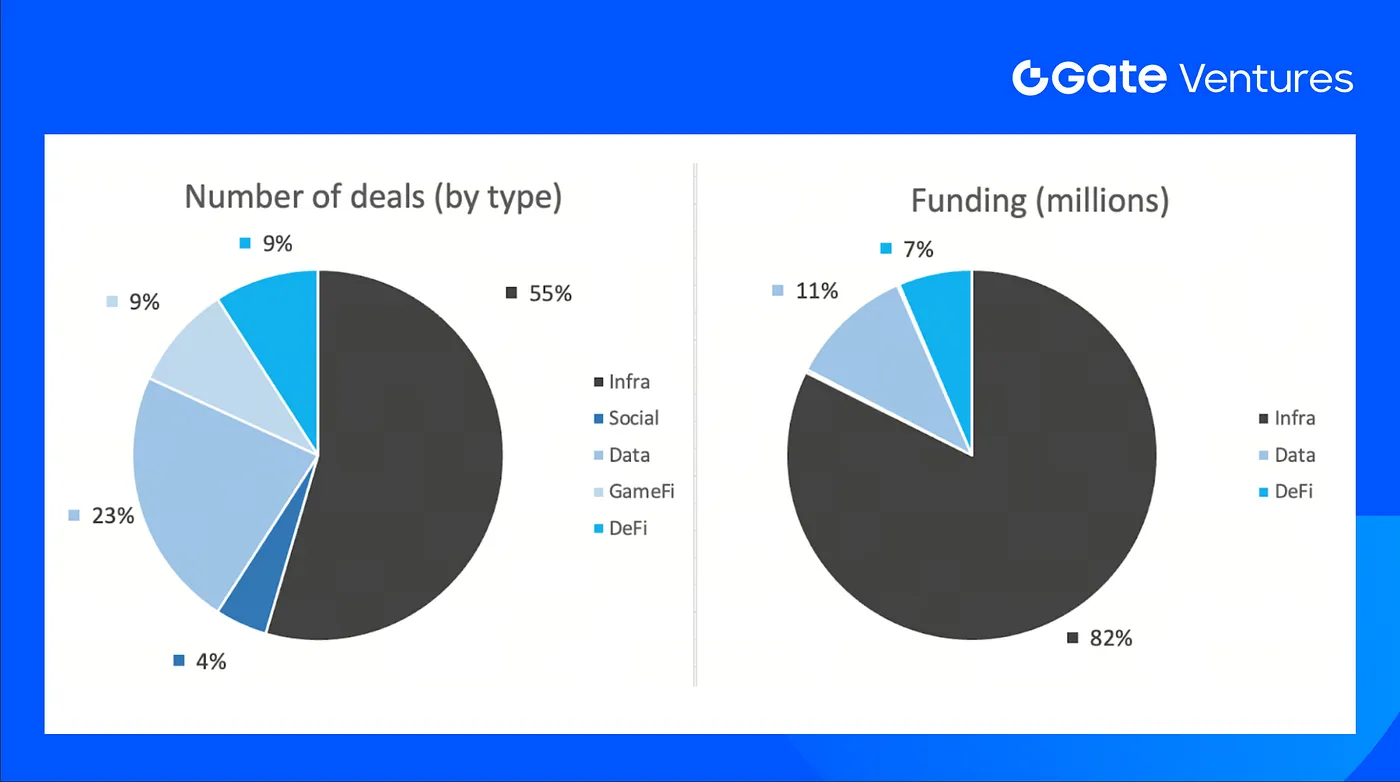

The number of deals closed in the previous week was 22, with Infra having 12 deals, representing 55% for each sector of the total number of deals. Meanwhile, Data had 5 (23%), Social had 1 (5%), Gamefi had 2 (9%) and DeFi had 2 (9%) deals.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 20th Oct 2025

The total amount of disclosed funding raised in the previous week was $781M, 18% deals (4/22) in previous week didn’t public the raised amount. The top funding came from Infra sector with $643M. Most funded deals: Tempo $500M, Daylight $60M.

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 20th Oct 2025

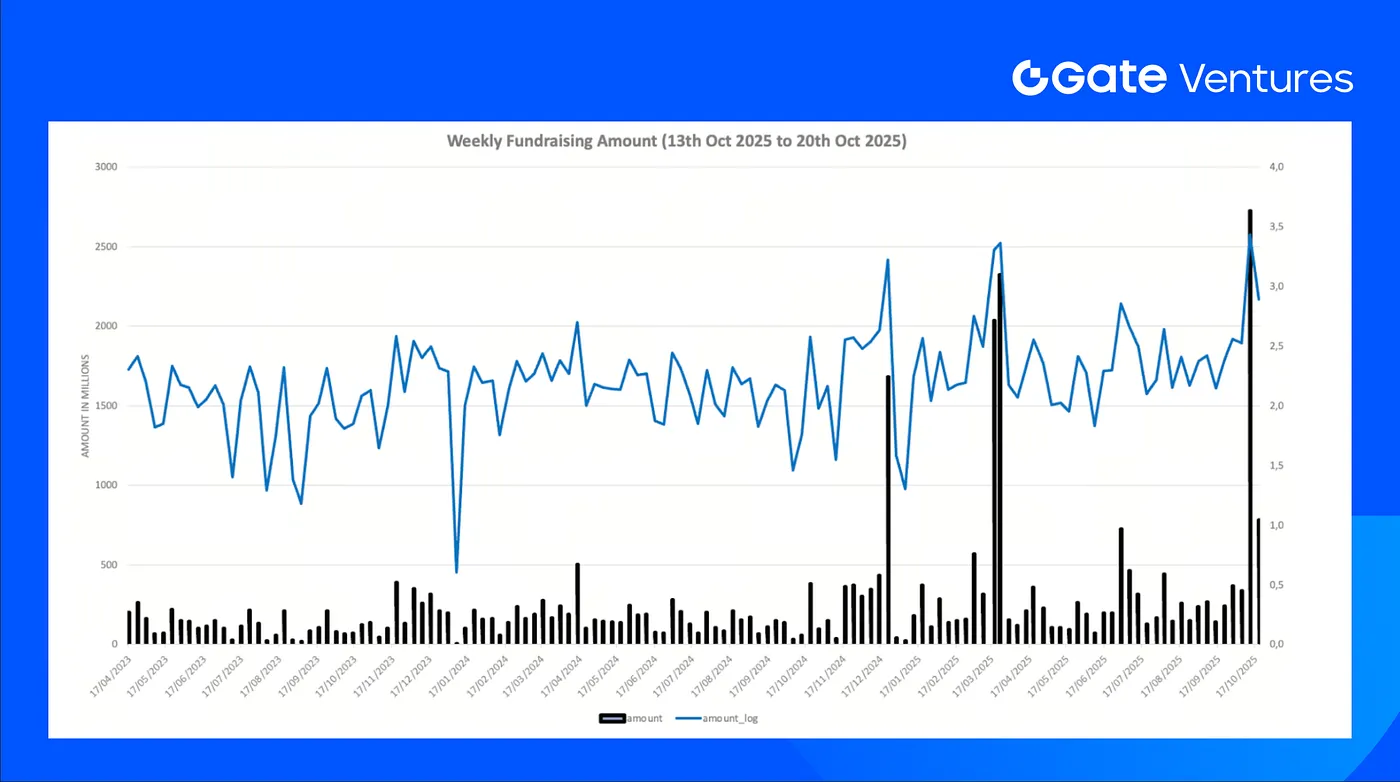

Total weekly fundraising fell to $781M for the 3rd week of Oct-2025, a decrease of -71% compared to the week prior. Weekly fundraising in the previous week was up +106% year over year for the same period.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation . You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

References

- S&P Global Weekly Ahead Economic Data, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-20-october-2025.html

- Reserves of Depository Institutions: Total/Total Assets, All Commercial Banks, https://fred.stlouisfed.org/graph/?g=wVqP

- TradingView on DXY Index, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US Treasury Security Issuance, https://www.sifma.org/resources/research/statistics/us-treasury-securities-statistics/

- TradingView on Gold, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Bittensor Halving News, https://www.ainvest.com/news/bittensor-tao-halving-driven-scarcity-play-catalyst-2025-bull-run-2510/

- Tether open-sources Wallet Development Kit to power global self-custody infrastructure,

https://tether.io/news/tether-champions-global-financial-freedom-infrastructure-with-open-source-release-of-its-wallet-development-kit-wdk/ - MegaETH repurchases 4.75% equity and token warrants ahead of mainnet launch,

https://www.theblock.co/post/375090/megaeth-buys-back-equity-token-warrants-pre-seed-investors - Aurelion completes $134M Tether Gold purchase, becomes NASDAQ’s first tokenized gold treasury,

https://www.prnewswire.com/news-releases/prestige-wealth-inc-nasdaq-aure-completes-134-million-purchase-of-tether-gold-xau-302583376.html?tc=eml_cleartime - Daylight raises $75M led by Framework Ventures and Turtle Hill Capital to scale decentralized home energy network, https://blog.godaylight.com/daylight-fundraise

- Inference secures $11.8M to scale privacy-preserving AI infrastructure for enterprises, https://inference.net/blog/seed-round

- Tempo secures $500M Series A at $5B valuation to build high-throughput stablecoin infrastructure, https://www.theblock.co/post/375152/stripe-tempo-500-million-series-a-thrive

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook

Gate Ventures Weekly Crypto Recap (September 15, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)