aped meaning

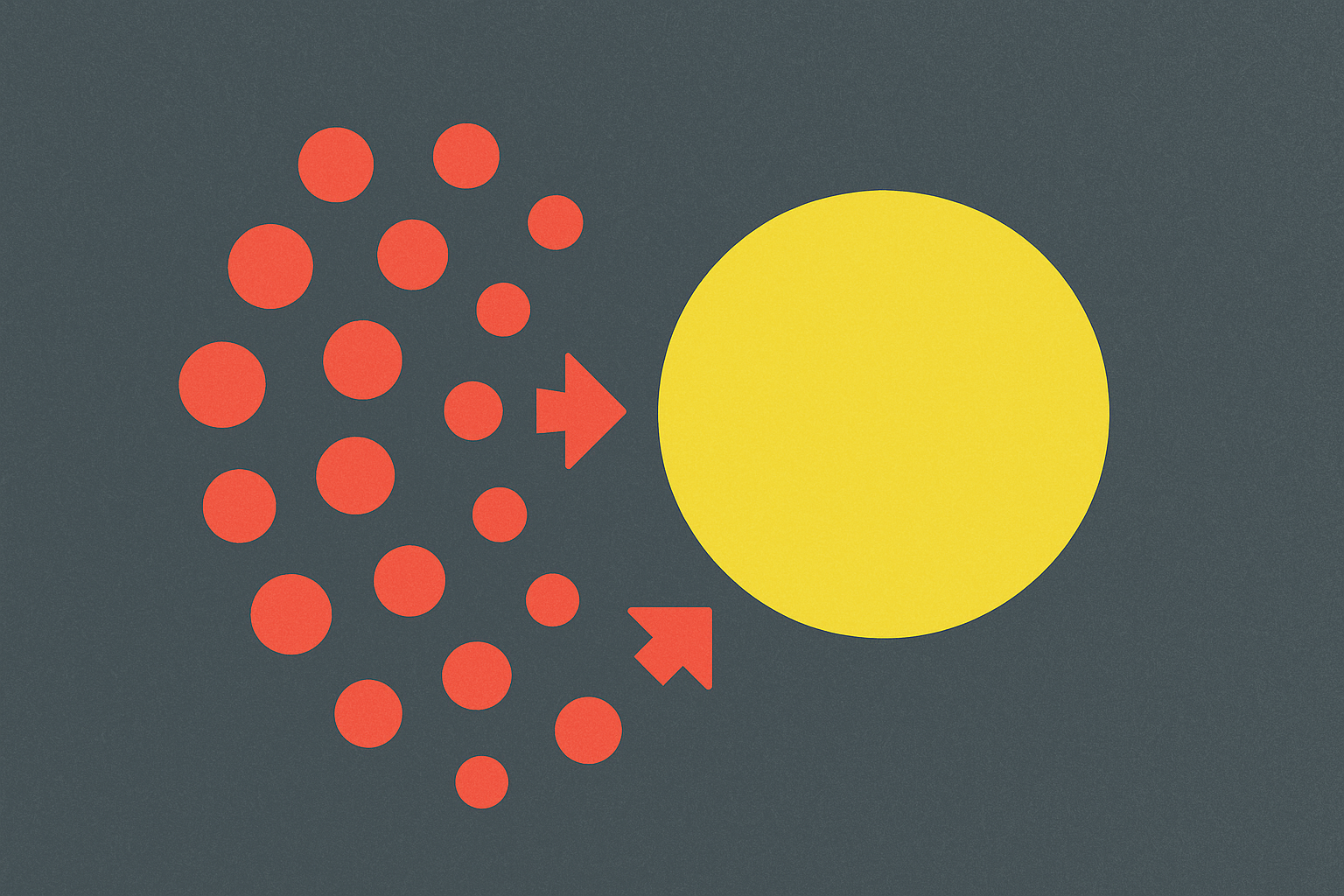

"Aped" is a slang term in the cryptocurrency market describing investors who allocate all their funds into a single asset, typically making impulsive decisions driven by emotions rather than thorough research. The term derives from the image of an "ape," suggesting investors blindly follow trends or act impulsively like primates. The aped phenomenon is particularly common during cryptocurrency market volatility periods and is closely associated with FOMO (Fear Of Missing Out) psychology, characterized by investors rushing to chase market trends while neglecting fundamental analysis and risk management principles.

What are the key features of aped meaning?

Emotion-driven decisions: Aping into investments typically stems from strong FOMO (Fear Of Missing Out), where investors quickly make investment decisions after seeing a token's price rapidly increase or hearing market buzz, rather than conducting thorough research.

Extreme risk exposure: Allocating all or most funds into a single asset completely violates investment diversification principles, exposing portfolios to enormous systemic risk.

Social media influence: Comments from crypto community influencers, Twitter/X trending topics, and Discord group discussions often catalyze aping behavior, especially when prominent figures publicly support a project.

Short-term thinking: Aping typically focuses on short-term price movements rather than long-term fundamentals, with investors hoping to gain quick returns from market volatility.

Trend chasing: Investors tend to pursue the most popular tokens, NFT collections, or DeFi protocols of the moment without considering the project's long-term sustainability or actual value.

What is the market impact of aped meaning?

The aping phenomenon has significant effects on cryptocurrency markets. First, it often leads to dramatic short-term price increases for specific assets, creating "explosive" rallies that attract even more investors, forming a short-term positive feedback loop. However, this collective behavior also intensifies market volatility, potentially triggering mass sell-offs and price crashes when sentiment reverses.

From a market structure perspective, aping behavior typically peaks during mid-bull markets, signaling overheated conditions. Experienced traders sometimes view explosions of aping sentiment on social media as potential contrarian indicators, especially when mainstream media begins reporting on "amazing returns" from certain tokens.

Additionally, the aping phenomenon reflects the maturity level of crypto markets. Compared to traditional financial markets, the crypto space has a higher proportion of retail investors with relatively less market education and risk management awareness, partly explaining why aping behavior is so prevalent in this domain.

What are the risks and challenges of aped meaning?

The aping strategy involves multiple serious risks that investors should fully understand:

-

Capital loss risk: Putting all funds into a single asset can lead to catastrophic portfolio losses if that asset's price crashes. The high volatility of crypto markets makes this risk particularly pronounced, as even large-cap cryptocurrencies can lose half their value in short timeframes.

-

Emotional decision-making trap: Aping often results from FOMO psychology, causing investors to buy at market peaks and subsequently experience price corrections. This emotion-driven decision-making typically leads to the unfavorable "buy high, sell low" outcome.

-

Liquidity risk: Particularly when investing in small-cap tokens or emerging projects, investors may face situations where they cannot sell their positions promptly or must accept significant price discounts when market sentiment reverses.

-

Psychological strain: Aping makes investors overly sensitive to price fluctuations of a single asset, potentially causing emotional turmoil, sleep issues, and even affecting daily life and work.

-

Loss of diversification benefits: Concentrated investing deprives investors of the opportunity to reduce risk and stabilize returns through asset diversification, violating fundamental investment principles.

While aping may yield substantial returns in specific situations, this strategy is too risky for most investors in the long term and lacks sustainability. Professional investors generally recommend more rational, systematic investment approaches, including capital management, risk diversification, and research-based decision processes.

Aping represents an extreme investment behavior in cryptocurrency markets, reflecting the unique psychology and social dynamics of this market. Although this pattern might bring significant gains to a lucky few in the short term, it contradicts mature risk management concepts from a long-term investment perspective. As crypto markets gradually mature, with increased investor education and institutional participation, the market may progressively shift away from such impulsive behaviors toward more rational and sustainable investment strategies. However, at the current stage, understanding the "aped" phenomenon and its risks remains significant for crypto market participants, helping to raise risk awareness and avoid emotion-driven investment decisions.

Share

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?