Gate Research: BTC and ETH Fluctuate in Sync | Crypto ETF Outflows Continue for Three Days

Summary

- BTC and ETH fluctuate in sync as market momentum continues to weaken, with overall sentiment entering a wait-and-see phase.

- Anza launches Jetstreamer to help Solana developers achieve ultra-high-speed ledger transmission.

- BlackRock’s BUIDL fund expands deployment on Aptos, promoting the development of the RWA tokenization ecosystem.

- Tesla earns $80 million in Q3 from its Bitcoin holdings, raising its digital asset value to $1.3 billion.

- Tempo announces a $500 million financing round on October 18 to accelerate its high-performance payment Layer 1 ecosystem.

Market Overview

Market Commentary

- BTC – After peaking in early October, BTC has continued to fluctuate between $106,000 and $112,000, with short-term resistance near the MA20 level. The current candlestick pattern shows consecutive small bodies, indicating strong investor caution. Trading volume has shrunk significantly compared with previous periods, and capital inflows and outflows have slowed. The MACD indicator remains below the zero axis, with the histogram turning from red to green again, showing that momentum continues to weaken and short-term rebound potential is limited. If the price remains suppressed below $116,000, watch for potential retests of the $108,000–$105,000 support zone; conversely, a breakout above the MA30 on strong volume could reopen rebound potential.

- ETH – Over the past week, ETH has maintained a weak sideways trend, hovering around $3,800, and remains capped by the MA20 and MA60 levels. While buy orders near the bottom limit further downside, effective rebound momentum remains lacking. The MACD lines are close together at low levels without forming a golden cross, and the histogram shortens below the zero axis, indicating that bearish momentum is easing but bulls have yet to take over. Unless ETH can stabilize above the $3,850–$3,900 range, it may continue consolidating at lower levels; only a breakout above the moving average resistance on strong volume would confirm a short-term rebound.

- Altcoins – The overall market has retraced this week, with only a few segments posting gains. The Wallets, Tokenized Gold, and Tokenized Commodities sectors performed relatively steadily, with 7-day average gains of 44.5%, 17.3%, and 15.7%, respectively.

- Stablecoins – The total stablecoin market capitalization currently stands at $316.1 billion, with overall trading volume rising significantly by 52.06%, indicating increased capital activity.

- Gas Fees – Ethereum network gas fees have declined this week, with the daily average at 0.107 Gwei as of October 23.

Trending Tokens

Most major altcoin sectors posted modest gains this week. According to CoinGecko data, the Wallets and Tokenized Gold sectors saw notable rises of 44.5% and 17.3%, respectively, over the past seven days. Below are representative tokens and reasons for their increases:

COAI ChainOpera AI (+70.21%, Circulating Market Cap $2.723B)

According to Gate market data, COAI is priced at $13.663, up 70.21% in 24 hours. ChainOpera AI is an AI Agent network centered on collaborative intelligence, aiming to build an open, community-driven AI economy. The project integrates autonomous learning agents, models, and GPU platforms to form a decentralized “AI Actor Network,” enabling agents to reason, make decisions, and transact autonomously via token incentives.

COAI’s strong recent rally is mainly driven by listings on multiple exchanges and rising market attention. As a flagship project in the “AI Agent + Decentralized Compute” narrative, ChainOpera is viewed as a potential leader in the next wave of AI blockchain ecosystems. According to official data, COAI holding addresses have surpassed 54,000, with user growth accelerating and the community expanding significantly. The top ten addresses hold about 87.9% of supply, showing a concentrated early-stage structure. With increasing user activity and liquidity, the project’s potential in integrating AI and compute networks is expected to continue supporting token value.

EVAA EVAA Protocol (+36.92%, Circulating Market Cap $53.7M)

Gate data shows EVAA is currently priced at $8.0487, up 36.92% in 24 hours. EVAA is a decentralized lending and yield protocol built on the TON ecosystem, recently attracting attention due to rising demand for its EVAA Voucher NFT series.

The rally appears driven by ecosystem engagement and incentive events. EVAA’s recent staking rewards and NFT lottery campaign drew heavy user participation, with winners receiving valuable Noir Vouchers. Combined with high APYs and cross-asset incentive mechanisms, market enthusiasm has surged. As TON ecosystem liquidity improves and NFT-integrated asset models spread, EVAA successfully captured narrative attention, fueling its strong 24-hour rally.

LIGHT Bitlight Labs (+11.57%, Circulating Market Cap $81.42M)

Gate data shows LIGHT is priced at $1.8882, up 11.57% in 24 hours and over 100% this week. Bitlight Labs focuses on the Bitcoin ecosystem, integrating Layer 1 and Layer 2 architectures for non-custodial Bitcoin operations and efficient payments. Its core product, BitLight, combines the RGB protocol’s client-side validation with Lightning Network payments, offering a secure and scalable integrated solution.

LIGHT’s recent rise is mainly driven by its whitepaper release and renewed market narrative. Bitlight Labs officially released its technical whitepaper on October 21, outlining innovations in non-custodial Bitcoin architecture. The project has drawn significant attention from developers and investors, and is widely seen as a potential key infrastructure linking the RGB and Lightning ecosystems—opening new possibilities for Bitcoin DeFi and asset-layer expansion.

Focus of the Week

BlackRock’s BUIDL Fund Expands Deployment on Aptos, Advancing RWA Tokenization

BlackRock’s digital liquidity fund BUIDL recently added $500 million of tokenized asset deployment to the Aptos network, making Aptos the second most adopted network by the fund after Ethereum. The total RWA tokenization scale on Aptos has surpassed $1.2 billion, ranking third globally. This expansion reflects growing institutional trust in emerging public chains and highlights multi-chain deployment as a key trend in asset tokenization. The BUIDL fund, jointly launched by BlackRock and tokenization platform Securitize, includes underlying assets such as cash, U.S. Treasuries, and repo agreements. Initially deployed on Ethereum in March 2024, and later expanded to Aptos in November 2024, it enables cross-chain asset issuance and yield-sharing mechanisms. The move marks BlackRock’s deeper integration into blockchain operations and strengthens Aptos’s competitiveness in the RWA sector.

Ethereum Foundation: Toward the “Era of Invisible Trust”

At the ETHShanghai 2025 main forum, Ethereum Foundation Co-Executive Director Hsiao-Wei Wang delivered a keynote titled “Mass Adoption of Ethereum: Crossing the Chasm.” She outlined three pillars for Ethereum’s path to mass adoption: (1) self-sovereignty, enabling users to truly own their assets; (2) global settlement capability, facilitating efficient value transfer and verification worldwide; and (3) everyday utility, where blockchain integrates naturally into daily life, such as payments and remittances.

She added that while scalability, cost, and UX challenges remain, Ethereum is advancing through account abstraction, including ERC-4337, EIP-7701, and EIP-7702, supporting social recovery wallets, gas sponsorship, and batch transactions to lower barriers to Web3 usage. Infrastructure efforts focus on mainnet security and financial application adoption. Wang emphasized that Ethereum’s ultimate goal is to make blockchain “invisible”—trusted and seamlessly embedded into life—marking the true realization of an Internet of Value.

Anza Launches Jetstreamer to Enable Ultra-Fast Ledger Streaming on Solana

Anza, a core development team in the Solana ecosystem, announced the launch of Jetstreamer, a tool designed to deliver ultra-efficient ledger data transfer for developers. It supports throughput exceeding 2.7 million ledger entries per second, greatly improving node synchronization and data retrieval efficiency. This advance allows developers to handle on-chain data with lower latency and higher throughput, strengthening Solana’s infrastructure scalability.

From an ecosystem perspective, Jetstreamer not only enhances Solana’s data accessibility but also provides new data interface standards for analytics platforms, validator nodes, and on-chain applications. As Solana’s high-frequency trading and DeFi applications increasingly demand real-time performance, Jetstreamer is expected to optimize development and deployment processes, reinforcing Solana’s leadership in high-performance blockchain infrastructure.

Key Market Data Highlights

Crypto ETF Outflows for Three Consecutive Days as Institutional Sentiment Cools

From October 16 to 22, spot Bitcoin ETFs recorded cumulative net outflows of approximately $144 million. BlackRock’s IBIT saw a single-day withdrawal of $268 million on October 17, marking the largest outflow in recent months; Grayscale’s GBTC also reported $25 million in outflows that day. Overall institutional sentiment remains cautious, as funds took profits amid market consolidation.

Despite a brief rebound on October 21 (inflow of about $477 million), outflows resumed on October 22 with $175 million withdrawn, suggesting buying momentum remains weak. Analysts note that this round of volatility is driven primarily by changing interest rate expectations and BTC price corrections, with ETF fund flows serving as a key market sentiment gauge.

Tesla Gains $80 Million in Q3 from Bitcoin Holdings, Digital Asset Value Rises to $1.3 Billion

Tesla (NASDAQ: TSLA) earned about $80 million in unrealized gains from Bitcoin price appreciation in Q3, increasing its digital asset holdings to $1.315 billion from $1.235 billion in the prior quarter. The company holds approximately 11,509 BTC, with no position changes during the quarter.

Boosted by Bitcoin’s rebound and strong core operations, Tesla’s Q3 revenue reached $28.1 billion, exceeding expectations of $26.36 billion. Adjusted EPS (excluding crypto gains) was $0.50, slightly below the expected $0.54. Under new FASB accounting rules, companies must recognize crypto fair value changes each quarter, implying Tesla’s future earnings volatility will more closely track Bitcoin’s price.

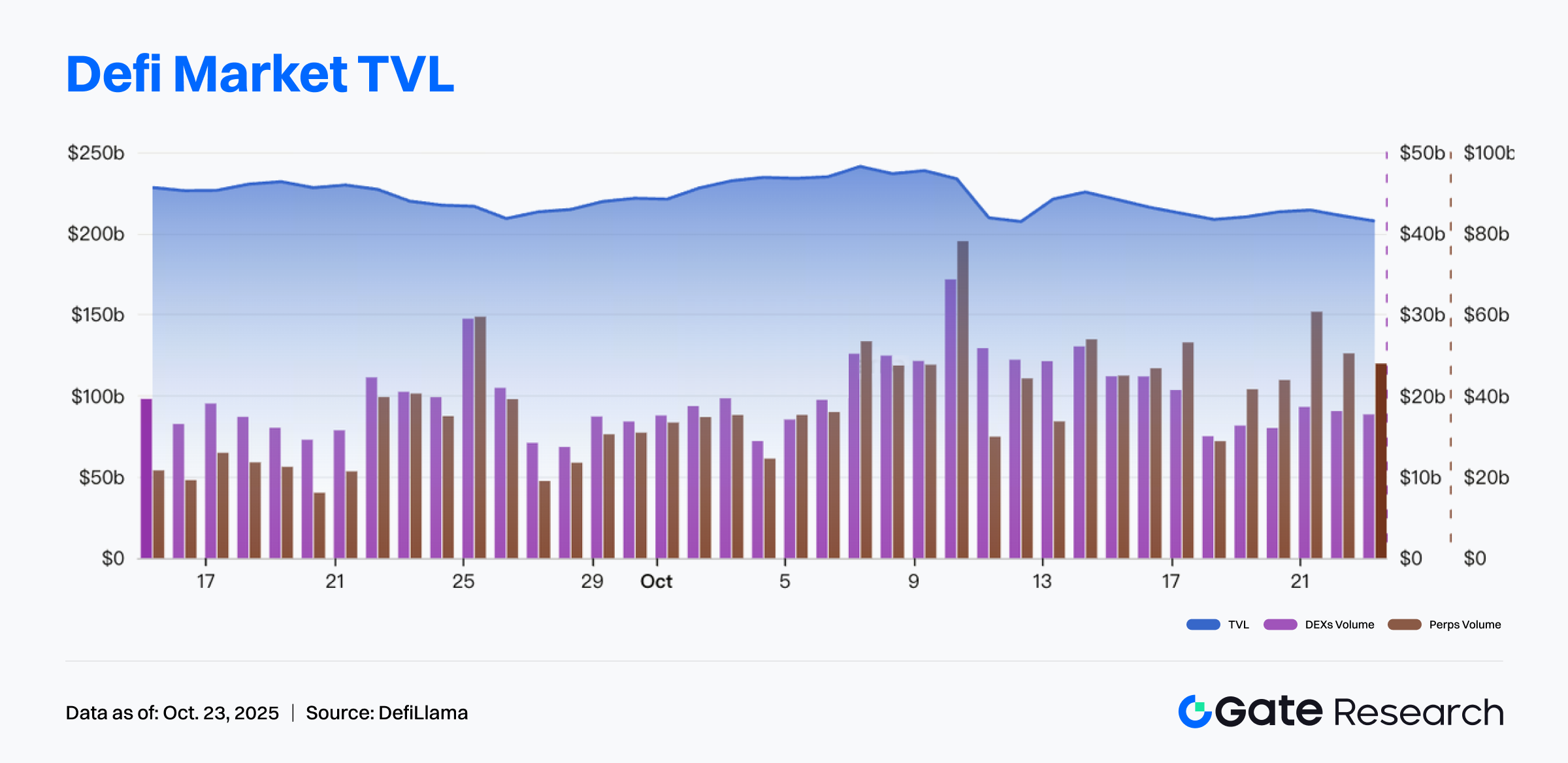

DeFi Market Maintains Adjustment as On-Chain Liquidity Stabilizes

Since October 16, total crypto trading volume has declined slightly, while leading DeFi protocols’ total value locked (TVL) has remained steady at around $220 billion, showing overall capital stability. Although short-term speculative activity has cooled, liquidity structures in core protocols and stablecoin ecosystems remain intact. Market trading volumes fell about 15–20% from the prior week. Analysts note that capital is currently in a redistribution phase, with investors cautious and waiting for macro clarity before re-entering risk assets.

Funding Weekly Recap

According to RootData, between October 16 and October 23, 2025, 29 crypto and related projects announced completed financing or M&A deals across public chains, investment platforms, and consumer sectors. Overall financing activity remained strong, showing continued capital deployment into BTC infrastructure, Layer 1 networks, and RWA tokenization. The top three deals this week:

Tempo

Announced a $500 million raise on October 18 to accelerate its high-performance Layer 1 payment ecosystem. Co-developed by Stripe and Paradigm, Tempo supports all major stablecoins, enabling low-cost, high-throughput global payments for enterprise use cases. The funds will help expand its developer ecosystem, enhance cross-border settlement capabilities, and drive stablecoin adoption in real-world commerce.

Echo

Announced a $375 million raise on October 21 to expand its Bitcoin-based insurance and financial product suite. Echo is a crypto angel investment platform allowing investors to form groups and co-invest in early-stage crypto projects, improving capital allocation efficiency and collaborative deal-making.

Greenlane

Announced a $110 million raise on October 20 to expand its brand portfolio, optimize supply chains, and strengthen its North American and European market presence. Greenlane is a global house of brands developing and distributing premium cannabis accessories, packaging, vape solutions, and lifestyle products.

Next Week to Watch

Token Unlocks

According to Tokenomist data, several major tokens will undergo significant unlocks between October 23 and October 30, 2025. The top three unlocks are:

- GRASS will unlock tokens worth about $71.94M in the next 7 days, accounting for 57.6% of circulating supply.

- XPL will unlock tokens worth about $31.07M in the next 7 days, accounting for 5.0% of circulating supply.

- JUP will unlock tokens worth about $18.37M in the next 7 days, accounting for 1.7% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- jin10, https://rili.jin10.com/

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- X, https://x.com/Aptos/status/1980680520569893038

- ETHShanghai 2025, https://ethshanghai.org/

- X, https://x.com/anza_xyz/status/1980801310162379204

- Farside, https://farside.co.uk/btc/

- Coindesk, https://www.coindesk.com/markets/2025/10/22/tesla-booked-usd80m-profit-on-bitcoin-holdings-in-q3

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

What Is Fundamental Analysis?