Surviving the biggest Crypto Crash in history: some thoughts

Happy Monday, friends!

For the past four years, crypto has been more than just an interest; it’s consumed my every thought and effort, from trading strategies to deep dives into protocols and endless conversations. The recent market crash shook me, but luck + risk management helped me survive where many were wiped out.

What truly drives me isn’t the money; it’s the relentless pursuit of growth, mastering my craft, and the love of the journey that keeps me pushing forward no matter what.

Before we start, let’s have a word from our partner, Wormhole:

The Monad launch is around the corner. And Wormhole is a key player in the Monad journey. Wormhole has already partnered with Monad to provide cross-chain support. This will help unlock billions in liquidity and generate substantial revenue. Not only that, but the Wormhole Reserve has launched, which will conduct $W buybacks.

With the shift to revenue-focused tokenomics in Wormhole 2.0, the upcoming Portal Earn launch, adoption by institutions like BlackRock and S&P 500, and more major products in the pipeline, $W is gaining value across the Wormhole ecosystem.

In general, there has been a shift to utility coins, and Wormhole has increased more in price than $HYPE, $SOL, and $PUMP over the past three months.

Some other bullish factors for $W:

-Fee switches live, generating revenue for $W token holders

-Used by Securitize, Uniswap infra, Google Cloud, etc.

-$60B+ cross-chain volume

-Rumors of an additional airdrop

-Backed by Jump, Multicoin, Brevan Howard, Coinbase Ventures, and ParaFi (raised $225M at $2.5B FDV)

The incentive to run this back is definitely there.

Stay updated here: https://x.com/wormhole

Surviving the biggest Crypto Crash in history: some thoughts

I’ve been thinking a lot about how I am spending my life. For the last 4 years, I’ve been 100% in crypto. And by 100%, I really mean it. Haven’t been doing much else, meaning that most of my waking hours have been directly, or indirectly spent thinking about crypto, trading, trying new protocols, talking to people, writing on Twitter, reading other people’s opinions on Twitter, browsing newsletters, podcasts (mostly transcripts basically because reading is like 5x faster than watching a vid/listening to a pod).

I really love hard work. I am obsessed with it. This doesn’t mean that my only interest is crypto, but for now, it is the main one. At some point, I will probably get bored, and then some weeks/months go by with lots of thinking before I eventually end up with something new. However, looking back, there’s no doubt that I’ve been quite obsessed with numbers and gambling.

The Black Friday event was scary, but I got out mostly untouched. I was delta neutral into the weekend on Lighter and my shorts weren’t auto-closed, which happened on eg. Hyperliquid. On the long leg I had spot positions only. I had no perp positions open on Bybit, but one day earlier I was pait trading DOGE/BTC with good size. I closed it out because I wanted a weekend with full rest, but can only imagine how rekt I’d become if I kept it open. So I was kind of lucky this time.

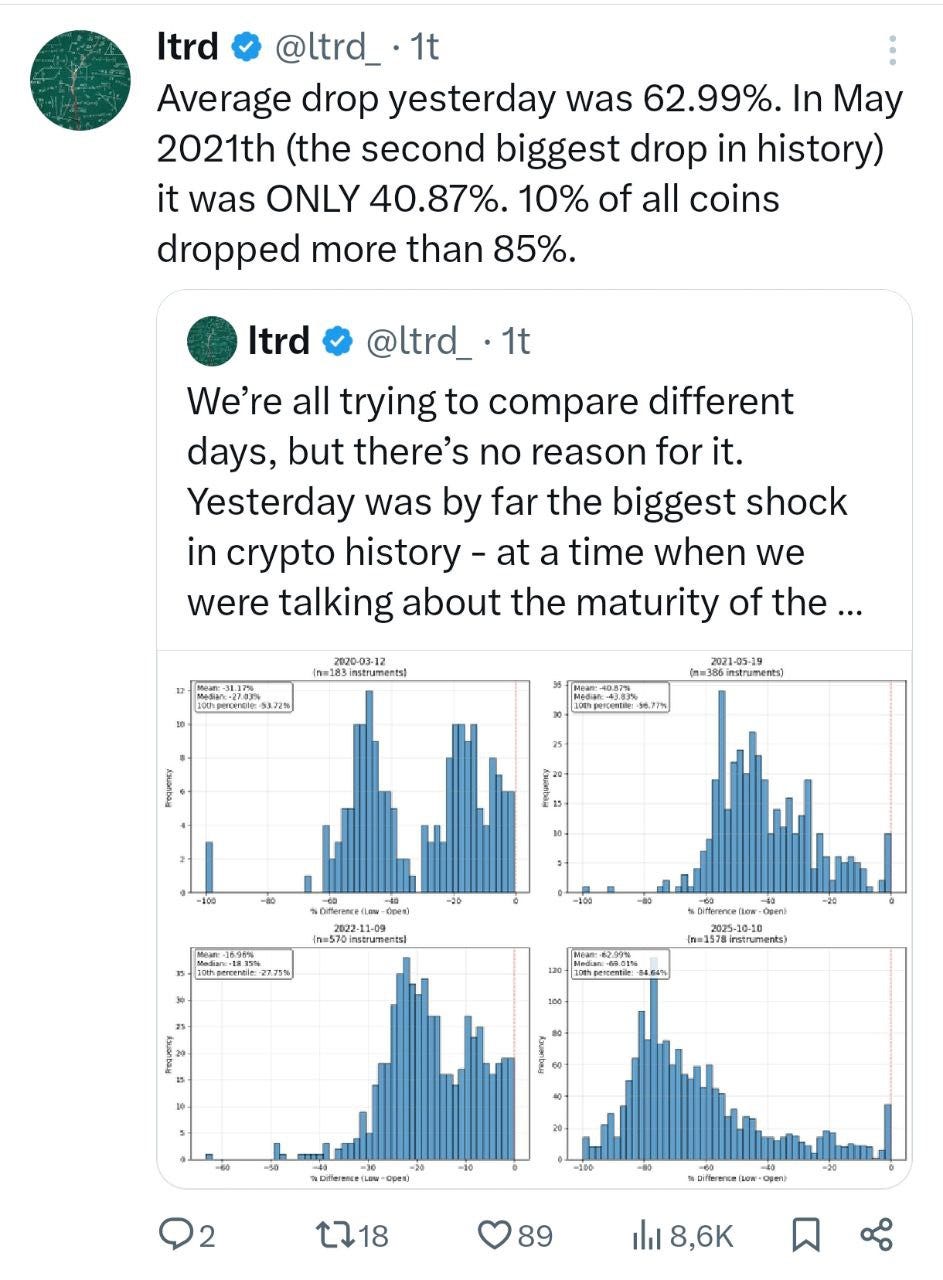

I usually use low leverage (2-3x), and for the purpose of reducing capital needed on the CEX/DEX, but it is pretty wild to me that altcoins on average were down 62%, while some altcoins went as low as 85-99% down. Which means that every leverage trader on the long side got rekt. Over the last years some of the wildest degens have entered CT, making it in Solana trenches, and eventually tried their luck in perps. We have normalized the use of leverage, and I use it on a daily basis myself. You can blame people and say they had no risk management, but IMO using 2-3x leverage is quite conservative. I don’t think people will stop using it tbh. In 1-2 weeks degens will play the game again as if nothing happened.

Like see the figure below, like how do you even hedge yourself from an altcoin drop on 63%? And that’s average. Most coins went way lower. Truly insane.

So who’s left to play this cycle?

The stubborn people who are careful, mostly owning spot assets and that consider new coins/projects for a long time before they ape in. They are not the ones who ape things first, and usually they don’t earn crazy gains, but at the same time, they have steadily compounded growth of their portfolio, year after year.

Perp traders are the one who got hit the hardest, and ironically I think that many shitcoin trenchers (Solana degens) are doing relatively okay, because they mostly trade their coins without leverage. Some of them ofc entered the perp game, and if they did, they’re prob rekt. But many just stayed in their lane, which means they lost money, but not everything, since it is spot positions.

For the perp DEXes, it is interesting to see what comes out of this. On Hyperliquid shorts were auto-closed, while on Lighter they weren’t. As a result HLP made money, while LLP lost money. No one knows where the future of perp dexes will be, but thanks to the stress test on Friday, there are plenty of lessons to learn and things to implement. Will we see changes to the buyback model for $HYPE for example? Is a 100% buyback sustainable?

Will I stop using leverage? No. I know I am the one responsible for my trades and my decisions. There will always be risks. If there are no risks, it just means there are no money to be made.

For DeFi I expect to see unwinding of positions going forward. DeFi did extremely well under Friday’s event, but people got scared, and I think many would prefer just holding assets in their own wallets vs. trusting another party. USDE did fine luckily. I like to think of Ethena as the bearer of DeFi. Ethena is holding the DeFi world on its shoulder. If something bad happens to them there will be mass implicatons, see for example Pendle (70% of Pendle’s TVL is due to Ethena).

Going forward I am thinking about what altcoins that would be the best bid. Personally leaning on $BNB, $MNT, and OG coins that has been around for a while. Also, I think the trenches might be a bit more quiet going forward, so PUMP and Fartcoin are not my main bets. For now I hold mostly stablecoins, and I am going to stick to pure news/narrative trading. You might not earn the most with this, but short term trades at least protect the book very well.

And just end this:

Most people never reach the money goal they dream about because they’re not built like the ones who do.

You’re going against people who live for this. They don’t count the hours working, and they don’t run when things get hard. Good days don’t make them rest, and bad days don’t make them stop; it’s all part of the same rhythm.

Money might be the surface goal, but what really drives them is the chase, the growth, the craft, the quiet sharpening of skill.

They don’t obsess over the finish line; they fall in love with the road.

That’s why, while others burn out or back out, they just keep winning, not because they have to, but because they can’t imagine not playing the game they love.

…

See you around, anon.

Disclaimer:

- This article is reprinted from [The Black s、Swans]. All copyrights belong to the original author [Route 2 FI]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?