Is XRP a Scam? A Deep Dive into Its Legitimacy and Market Controversies

What Is XRP?

XRP is a cryptocurrency issued by Ripple Labs with the goal of improving global payment system efficiency. Unlike the decentralized approaches of Bitcoin or Ethereum, XRP is designed to facilitate cross-border transactions between financial institutions. It features rapid transaction speeds, minimal fees, and the XRP Ledger enables real-time settlement. The primary use cases for XRP include:

- Accelerating cross-border payments: Enables banks and payment providers to complete transactions in seconds.

- Providing liquidity: Serves as a bridge currency for facilitating conversions between fiat currencies and cryptocurrencies.

- Reducing costs: Cuts down the time and fees required for traditional cross-border transfers.

Why Do Some People Question Whether XRP Is a Scam?

XRP has faced significant controversy, driven primarily by these factors:

- High degree of centralization

Although the XRP Ledger is open source, Ripple Labs holds a substantial portion of XRP tokens, raising investor concerns about possible price manipulation. - SEC lawsuit

In 2020, the U.S. Securities and Exchange Commission (SEC) accused Ripple Labs of issuing unregistered securities, sparking widespread debate about XRP’s legal status. - Marketing hype and misinformation

Certain communities and media outlets have over-promoted XRP’s features and potential, leading new investors to expect unrealistic returns and fueling scam suspicions.

Does XRP Really Carry Fraud Risks?

From a Web3 and crypto market perspective, it is not entirely accurate to label XRP as a scam. Investors should still be aware of certain risks:

XRP Transparency

- Public ledger: All transactions on the XRP Ledger are transparent and traceable.

- Open-source technology: The developer community can audit the codebase, enhancing trust.

Investment Risks

- Significant price volatility: XRP’s price is highly sensitive to market sentiment and regulatory developments.

- Centralized control: Ripple Labs’ large holdings of XRP can affect market supply and pricing.

XRP is not a scam in the conventional sense. However, its risk profile and legal controversies mean that investors should evaluate it carefully before investing.

XRP’s Legality and Growth Potential

Despite ongoing SEC litigation, XRP retains several core value propositions that drive its market relevance:

- Adoption by financial institutions

Many banks and payment companies use Ripple’s payment network, which shows the practical utility of XRP’s technology. - Transaction speed and cost advantage

XRP settles transactions in seconds, and fees are extremely low. This makes it highly competitive for cross-border payments. - Web3 integration potential

The XRP Ledger supports smart contracts and decentralized applications, paving the way for future DeFi expansion.

How Should You Evaluate Whether XRP Is Worth Investing In?

Investing in XRP—or any cryptocurrency—requires rational analysis:

- Understand the technology and utility

XRP is not purely a speculative asset; its value is tied to adoption within payment networks and financial institutions. - Monitor legal and regulatory risks

SEC litigation and changing regulations directly impact XRP’s price volatility and the legal status of trading XRP. - Manage portfolio allocation and risk

Given XRP’s volatility, investors should allocate a reasonable portion of their funds and avoid over-concentration. - Stay informed on market trends and community updates

XRP’s price is closely linked to market sentiment; regularly follow Ripple’s official announcements, exchange developments, and crypto news.

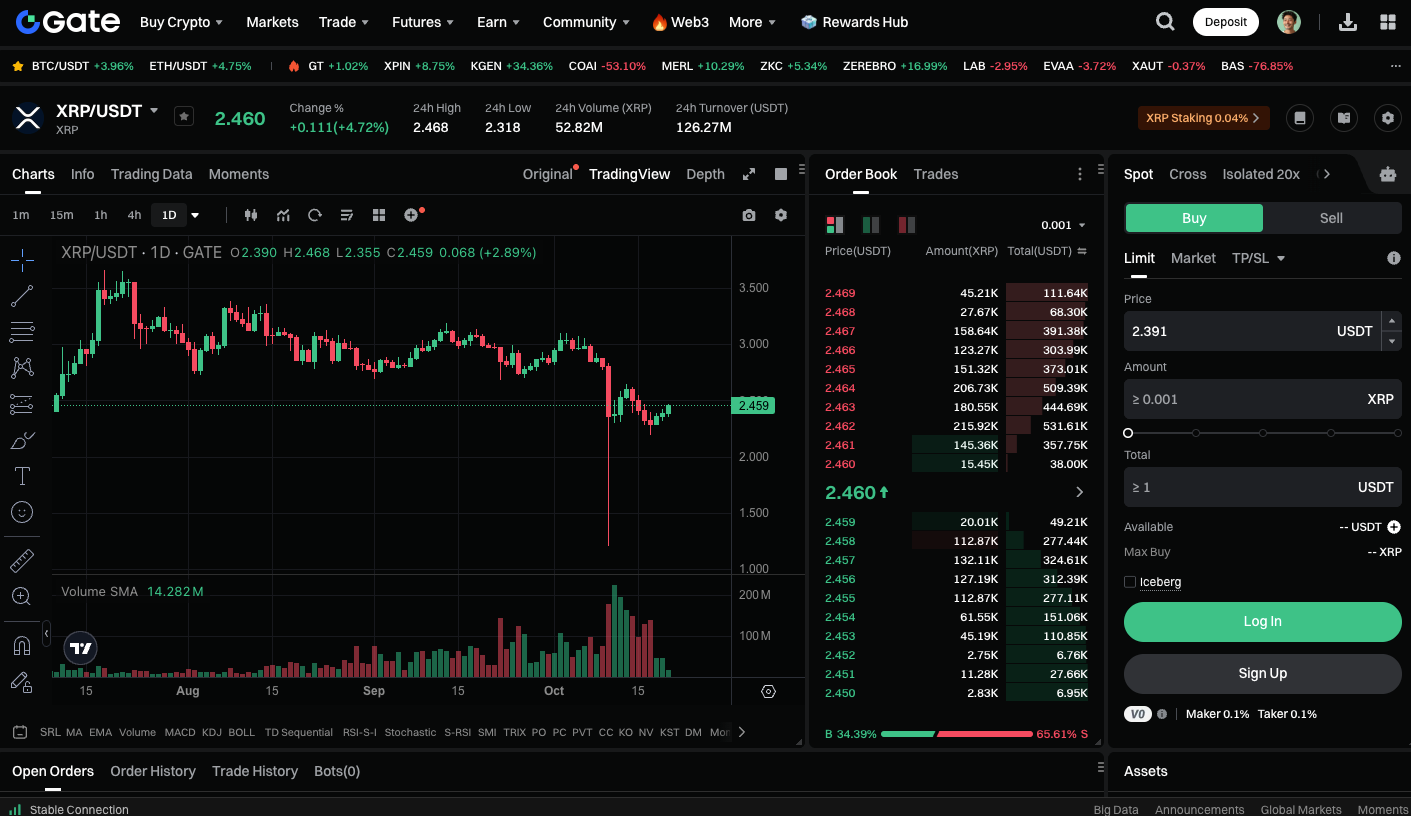

You can view XRP spot trading here: https://www.gate.com/trade/XRP_USDT

Summary

XRP is backed by legitimate technology and real-world use cases, but investing in XRP involves legal uncertainties, centralization risks, and significant price volatility. Investors should exercise caution. For those interested in Web3 investment opportunities, XRP offers cross-border payment capabilities, low-cost transfers, and potential DeFi applications.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article