2025 XTZ Price Prediction: Analyzing Tezos' Potential in the Evolving Crypto Landscape

Introduction: XTZ's Market Position and Investment Value

Tezos (XTZ), as a self-evolving blockchain platform, has made significant strides in the cryptocurrency space since its inception in 2017. As of 2025, Tezos has reached a market capitalization of $649,742,708, with a circulating supply of approximately 1,062,018,157 XTZ, and a price hovering around $0.6118. This asset, often referred to as the "self-amending crypto-ledger," is playing an increasingly crucial role in decentralized governance and smart contract development.

This article will provide a comprehensive analysis of Tezos' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. XTZ Price History Review and Current Market Status

XTZ Historical Price Evolution

- 2018: XTZ launched, price dropped to its all-time low of $0.350476 on December 7

- 2021: Bull market peak, XTZ reached its all-time high of $9.12 on October 4

- 2022-2023: Crypto winter, price declined significantly from its peak

XTZ Current Market Situation

As of October 16, 2025, XTZ is trading at $0.6118. The token has experienced a 2.94% decrease in the last 24 hours, with a trading volume of $561,815. XTZ's market capitalization stands at $649,742,708, ranking it 125th in the global cryptocurrency market.

Over the past week, XTZ has seen a 10.34% decline, while the 30-day performance shows an 18.98% decrease. The year-to-date performance indicates a 12.72% drop. Despite these short-term downtrends, XTZ is still trading significantly above its all-time low.

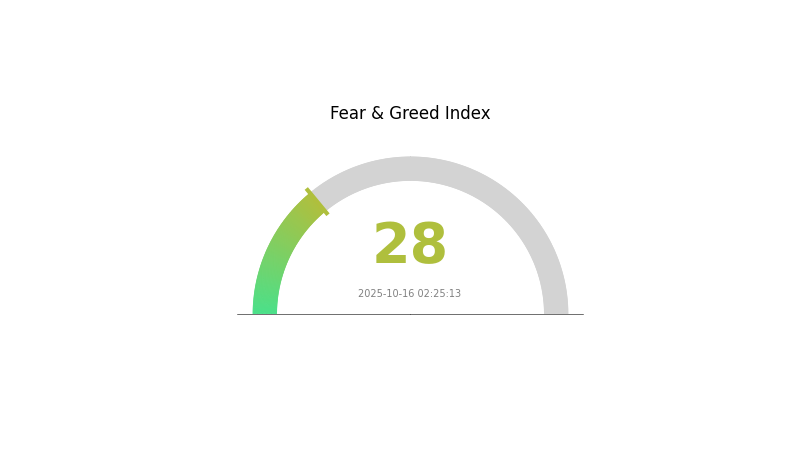

The current market sentiment for cryptocurrencies, including XTZ, is cautious, with the Fear and Greed Index indicating "Fear" at a value of 28. This suggests that investors are currently risk-averse in the crypto market.

Click to view the current XTZ market price

XTZ Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently in a state of fear, with the Fear and Greed Index registering at 28. This indicates a cautious sentiment among investors, potentially signaling an opportunity for contrarian traders. During periods of fear, some investors may consider accumulating assets at potentially lower prices. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market conditions can change rapidly, and past performance doesn't guarantee future results.

XTZ Holdings Distribution

The address holdings distribution data for XTZ reveals an interesting picture of its current market structure. This metric provides insight into the concentration of XTZ tokens across different addresses on the blockchain.

Notably, the absence of any addresses holding significant percentages of the total XTZ supply suggests a relatively decentralized distribution. This lack of large individual holders or "whales" indicates that the XTZ market may be less susceptible to price manipulation by a small number of actors. Such a distribution pattern generally contributes to increased market stability and reduced volatility.

Furthermore, this dispersed holding pattern aligns well with the principles of decentralization that many blockchain projects strive for. It suggests that XTZ has achieved a level of distribution that could support a more robust and resilient network, potentially enhancing its long-term sustainability and reducing systemic risks associated with concentrated ownership.

Click to view the current XTZ Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Influencing XTZ's Future Price

Technological Development and Ecosystem Building

-

Self-Upgrade Mechanism: Tezos' built-in self-correction mechanism allows upgrades through on-chain proposals and voting, avoiding the uncertainty of hard forks and enhancing protocol stability and continuity.

-

Formal Verification: Tezos supports formal verification, using mathematical methods to verify the correctness of contracts, ensuring enhanced security for financial-grade applications like DeFi and RWA.

-

Ecosystem Applications: Tezos focuses on decentralized finance (DeFi), digital asset tokenization (including NFTs and RWAs), and enterprise-level applications.

Macroeconomic Environment

- Regulatory Approval: Clear recognition of Tezos as a compliant blockchain by markets such as the EU and the US would facilitate enterprise and institutional adoption.

III. XTZ Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.46406 - $0.55

- Neutral prediction: $0.55 - $0.65

- Optimistic prediction: $0.65 - $0.70219 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.67231 - $0.97288

- 2028: $0.76727 - $1.31405

- Key catalysts: Technological advancements, wider ecosystem expansion, and potential institutional interest

2029-2030 Long-term Outlook

- Base scenario: $0.91133 - $1.22425 (assuming steady market growth and continued development)

- Optimistic scenario: $1.22425 - $1.35052 (assuming strong market performance and increased mainstream adoption)

- Transformative scenario: $1.35052+ (assuming breakthrough innovations and widespread blockchain integration)

- 2030-12-31: XTZ $1.26098 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.70219 | 0.6106 | 0.46406 | 0 |

| 2026 | 0.92552 | 0.6564 | 0.43322 | 7 |

| 2027 | 0.97288 | 0.79096 | 0.67231 | 29 |

| 2028 | 1.31405 | 0.88192 | 0.76727 | 44 |

| 2029 | 1.35052 | 1.09799 | 0.91133 | 79 |

| 2030 | 1.26098 | 1.22425 | 0.85698 | 100 |

IV. XTZ Professional Investment Strategies and Risk Management

XTZ Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable growth

- Operation suggestions:

- Accumulate XTZ during market dips

- Set price targets and rebalance periodically

- Store XTZ in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Trade with the trend, not against it

- Use stop-loss orders to manage risk

XTZ Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: Up to 15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official Tezos wallet

- Security precautions: Enable two-factor authentication, use strong passwords

V. XTZ Potential Risks and Challenges

XTZ Market Risks

- Volatility: XTZ price can experience significant fluctuations

- Liquidity: Lower trading volume compared to top cryptocurrencies

- Market sentiment: Susceptible to broader crypto market trends

XTZ Regulatory Risks

- Uncertain regulations: Potential for unfavorable government policies

- Tax implications: Evolving tax laws may impact XTZ holders

- Compliance challenges: Increased scrutiny on crypto projects

XTZ Technical Risks

- Smart contract vulnerabilities: Potential for exploits in DApps

- Network congestion: Scalability issues during high-traffic periods

- Upgrade risks: Potential bugs or issues during protocol updates

VI. Conclusion and Action Recommendations

XTZ Investment Value Assessment

Tezos offers long-term potential through its self-amending blockchain and formal verification features. However, short-term volatility and regulatory uncertainties pose risks.

XTZ Investment Recommendations

✅ Beginners: Start with small, regular investments to learn the market ✅ Experienced investors: Consider a balanced portfolio with XTZ as a growth asset ✅ Institutional investors: Explore staking opportunities and governance participation

XTZ Trading Participation Methods

- Spot trading: Buy and sell XTZ on Gate.com

- Staking: Participate in Tezos baking to earn rewards

- DeFi: Explore decentralized finance applications built on Tezos

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does XTZ have a future?

Yes, XTZ has a promising future. Its growing adoption, innovative technology, and active development suggest long-term potential for Tezos in the blockchain space.

What will XTZ be worth in 2030?

Based on expert predictions, XTZ could be worth around $15.80 by 2030. Analysts expect the price to range between $4.29 and $3.70 in 2029, with potential for further growth.

Is Tezos a good crypto?

Tezos offers unique features like a self-amending blockchain and staking rewards. While facing competition, it remains a viable option for investors interested in its innovative governance model and long-term potential.

What is the highest price of Tezos?

The highest price of Tezos reached $8.82 in December 2017.

Share

Content