2025 LDO Price Prediction: Bullish Outlook as DeFi Adoption Soars and Ethereum Staking Grows

Introduction: LDO's Market Position and Investment Value

Lido DAO Token (LDO) has established itself as a key player in the liquid staking ecosystem since its inception in 2020, pioneering decentralized staking solutions for Ethereum. As of 2025, LDO boasts a market capitalization of $825,379,877, with a circulating supply of approximately 895,788,884 tokens, and a price hovering around $0.9214. This asset, often referred to as the "liquidity enabler for ETH 2.0," is playing an increasingly crucial role in the decentralized finance (DeFi) landscape.

This article will provide a comprehensive analysis of LDO's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem developments, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. LDO Price History Review and Current Market Status

LDO Historical Price Evolution

- 2021: LDO reached its all-time high of $7.3 on August 20, marking a significant milestone for the token.

- 2022: The market experienced a downturn, with LDO hitting its all-time low of $0.40615 on June 19.

- 2025: The market has shown signs of recovery, with LDO currently trading at $0.9214.

LDO Current Market Situation

As of October 16, 2025, LDO is trading at $0.9214, with a market capitalization of $825,379,877. The token has experienced a 5.7% decrease in the past 24 hours, indicating short-term volatility. Over the past week, LDO has seen a significant decline of 22.91%, suggesting a bearish trend in the medium term. The 30-day and 1-year price changes are -21.65% and -19.42% respectively, pointing to an overall downward trend in the longer term. Despite these recent declines, LDO is still trading well above its all-time low, demonstrating some resilience in the market. The current circulating supply is 895,788,883 LDO, representing 89.58% of the total supply of 1 billion tokens.

Click to view the current LDO market price

LDO Market Sentiment Indicator

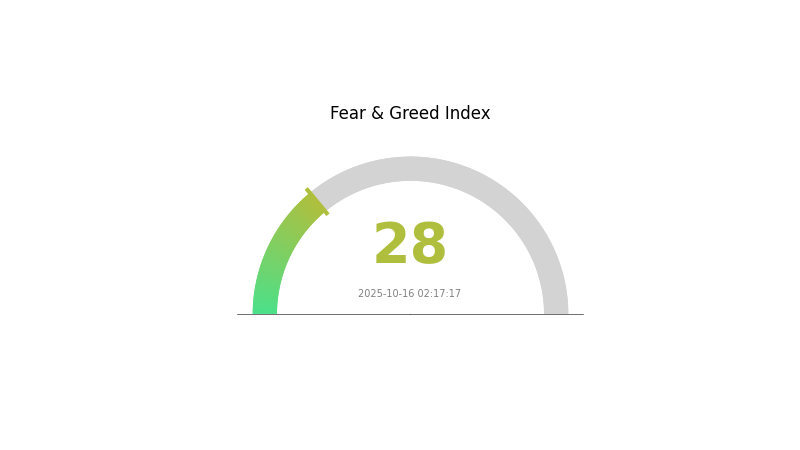

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for LDO is currently in the "Fear" zone, with a score of 28. This indicates a cautious atmosphere among investors. During such periods, some may view it as a potential buying opportunity, adhering to the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions in the volatile crypto market.

LDO Holdings Distribution

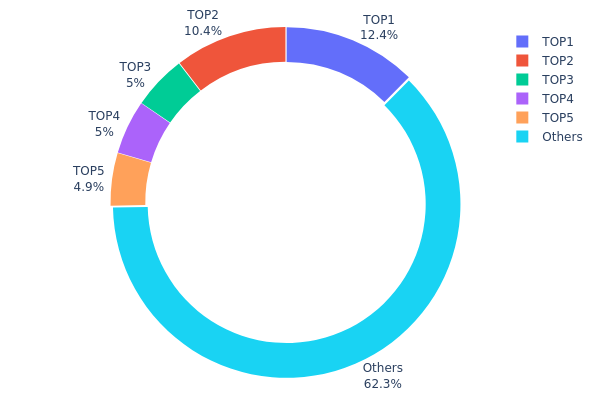

The address holdings distribution data provides crucial insights into the concentration of LDO tokens. Based on the provided data, we observe a significant concentration among the top holders. The largest address holds 12.41% of the total supply, followed by another holding 10.42%. The third and fourth largest holders each possess 5% of the supply, while the fifth holds 4.90%.

This distribution pattern indicates a moderate level of concentration, with the top five addresses collectively controlling 37.73% of the total LDO supply. While this concentration is notable, it's not necessarily alarming for a blockchain project. However, it does suggest that these large holders could potentially influence market dynamics and price movements if they were to make significant trades.

The remaining 62.27% distributed among other addresses implies a reasonable level of decentralization beyond the top holders. This broader distribution can contribute to market stability and resilience against potential manipulation attempts. Nevertheless, investors and analysts should continue to monitor these large holdings, as any substantial changes could impact LDO's market structure and price volatility.

Click to view the current LDO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 124133.33K | 12.41% |

| 2 | 0x3e40...6e9c8c | 104211.12K | 10.42% |

| 3 | 0x695c...917740 | 50000.00K | 5.00% |

| 4 | 0x9457...72168b | 50000.00K | 5.00% |

| 5 | 0xad4f...8b42da | 49000.00K | 4.90% |

| - | Others | 622655.56K | 62.27% |

II. Key Factors Affecting LDO's Future Price

Supply Mechanism

- Staking Rewards: The mechanism of distributing staking rewards directly impacts LDO's value proposition and demand.

- Historical Pattern: Historically, increases in staking rewards have positively correlated with LDO price appreciation.

- Current Impact: The expected growth in Ethereum 2.0 staking demand is likely to drive increased adoption of Lido's services, potentially boosting LDO's value.

Institutional and Whale Dynamics

- Institutional Holdings: Major DeFi and crypto investment firms have shown increasing interest in LDO, signaling growing institutional adoption.

- Enterprise Adoption: Ethereum-based enterprises exploring staking solutions may turn to Lido, indirectly affecting LDO demand.

- National Policies: Regulatory clarity on staking services in major economies could significantly impact Lido's operational scope and LDO's market performance.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those affecting crypto markets, may influence LDO's price through broader market sentiment.

- Inflation Hedging Properties: LDO's connection to Ethereum staking could position it as a potential inflation hedge, similar to other crypto assets.

- Geopolitical Factors: Global economic uncertainties may drive interest in decentralized finance solutions, potentially benefiting LDO.

Technical Development and Ecosystem Building

- Ethereum 2.0 Progress: Ongoing Ethereum upgrades and the transition to Proof-of-Stake directly impact Lido's core business and LDO's value proposition.

- Multi-chain Expansion: Lido's efforts to expand services to other blockchains beyond Ethereum could diversify its user base and increase LDO utility.

- Ecosystem Applications: The growth of DeFi protocols utilizing Lido's liquid staking solutions could drive increased demand for LDO tokens.

III. LDO Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.51 - $0.70

- Neutral forecast: $0.70 - $0.92

- Optimistic forecast: $0.92 - $1.20 (requires strong market recovery and increased Ethereum staking demand)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range predictions:

- 2027: $0.82 - $1.59

- 2028: $1.17 - $2.05

- Key catalysts: Ethereum ecosystem expansion, improved staking solutions, and broader DeFi integration

2029-2030 Long-term Outlook

- Base scenario: $1.75 - $1.98 (assuming steady growth in Ethereum adoption)

- Optimistic scenario: $1.98 - $2.20 (with significant Ethereum upgrades and market dominance)

- Transformative scenario: $2.20+ (extreme favorable conditions such as mass institutional adoption)

- 2030-12-31: LDO $1.98 (projected average price, indicating substantial growth from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.20481 | 0.9197 | 0.51503 | 0 |

| 2026 | 1.52965 | 1.06225 | 0.70109 | 15 |

| 2027 | 1.59402 | 1.29595 | 0.81645 | 41 |

| 2028 | 2.05188 | 1.44498 | 1.17044 | 57 |

| 2029 | 2.20302 | 1.74843 | 0.97912 | 90 |

| 2030 | 2.05475 | 1.97573 | 1.77815 | 115 |

IV. Professional Investment Strategies and Risk Management for LDO

LDO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to Ethereum staking ecosystem

- Operation suggestions:

- Accumulate LDO during market dips

- Hold for at least 1-2 years to capture potential growth

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points

- Use stop-loss orders to manage risk

LDO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, backup private keys

V. Potential Risks and Challenges for LDO

LDO Market Risks

- Volatility: Extreme price fluctuations common in crypto markets

- Liquidity: Potential difficulties in large volume trades

- Competition: Emergence of rival liquid staking protocols

LDO Regulatory Risks

- Uncertain regulations: Potential for unfavorable regulatory actions

- Compliance issues: Changing legal landscape for DeFi projects

- Tax implications: Unclear tax treatment of staking rewards

LDO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Ethereum upgrade risks: Dependency on successful Ethereum transitions

- Centralization concerns: Reliance on Lido governance decisions

VI. Conclusion and Action Recommendations

LDO Investment Value Assessment

LDO presents a unique opportunity to gain exposure to Ethereum's staking ecosystem. Long-term potential is tied to Ethereum's success and DeFi growth. Short-term risks include market volatility and regulatory uncertainties.

LDO Investment Recommendations

✅ Beginners: Consider small allocation as part of a diversified crypto portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy ✅ Institutional investors: Explore LDO as part of a broader DeFi investment thesis

LDO Trading Participation Methods

- Spot trading: Buy and hold LDO on Gate.com

- Staking: Participate in Lido's liquid staking protocol

- Yield farming: Explore LDO-based liquidity provision opportunities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for LDO token in 2030?

Based on current market analysis, the LDO token is predicted to reach an average price of $44.69 in 2030, with a potential range between $43.05 and $48.09.

Is ldo a good coin to buy?

LDO could be a good buy for those interested in Lido's ecosystem. As a governance token, its value is tied to Lido's growth and adoption in the DeFi space.

What is the price prediction for LDOS stock?

LDOS stock is predicted to reach $131-$165 by 2025 and $200-$258 by 2030. The forecast for tomorrow is $137.34.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed by Ethereum (ETH) and Solana (SOL).

Share

Content