2025 GUSD Price Prediction: Analyzing Stability and Growth Potential in the Stablecoin Market

Introduction: GUSD's Market Position and Investment Value

GUSD (GUSD), as a flexible, principal-protected investment product, has been providing relatively stable yields since its inception. As of 2025, GUSD's market capitalization has reached $148,102,161, with a circulating supply of approximately 148,221,943 tokens, and a price hovering around $0.9993. This asset, known as a "yield-bearing certificate," is playing an increasingly crucial role in offering stable returns within the Gate ecosystem.

This article will comprehensively analyze GUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GUSD Price History Review and Current Market Status

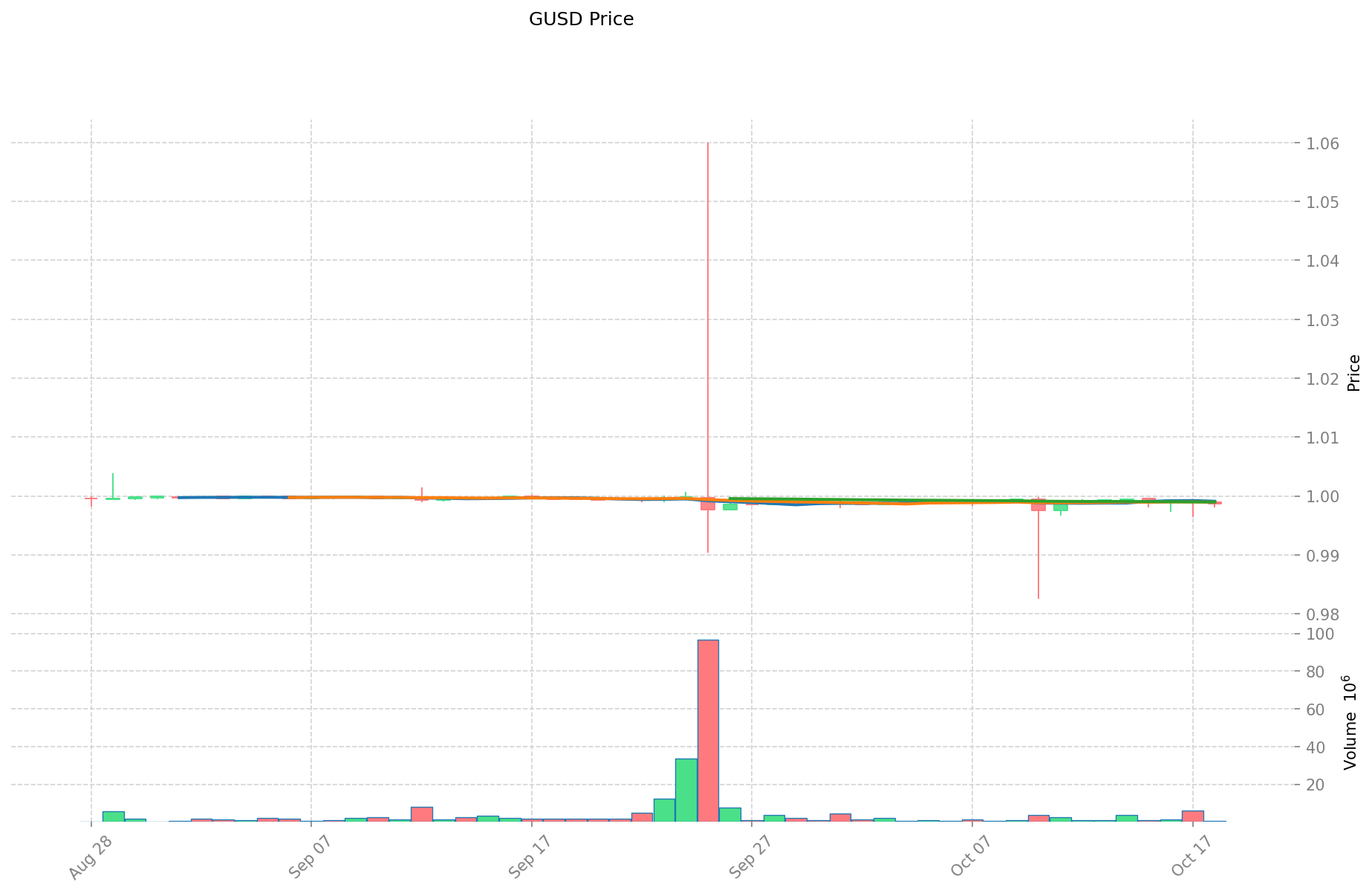

GUSD Historical Price Evolution

- 2025: GUSD launched, price initially set at $1

- 2025: Reached all-time high of $1.06 on September 25

- 2025: Experienced slight dip, reaching all-time low of $0.9826 on October 10

GUSD Current Market Situation

As of October 19, 2025, GUSD is trading at $0.9993, showing a 0.02% increase in the past 24 hours. The token has a market capitalization of $148,102,161, ranking 327th in the overall cryptocurrency market. The 24-hour trading volume stands at $423,906.71, indicating moderate market activity.

GUSD's current price is very close to its pegged value of $1, demonstrating its stability as a stablecoin. The token has shown resilience, recovering from its recent all-time low and maintaining a tight range around its target price. With a circulating supply of 148,221,943.61 GUSD out of a total supply of 320,000,000, the token has a circulating ratio of 46.31%.

The market sentiment for GUSD appears neutral to slightly positive, with small gains observed across various timeframes. The token has seen a 0.05% increase over the past week and a minimal 0.03% decrease over the last 30 days, suggesting overall stability in its price performance.

Click to view the current GUSD market price

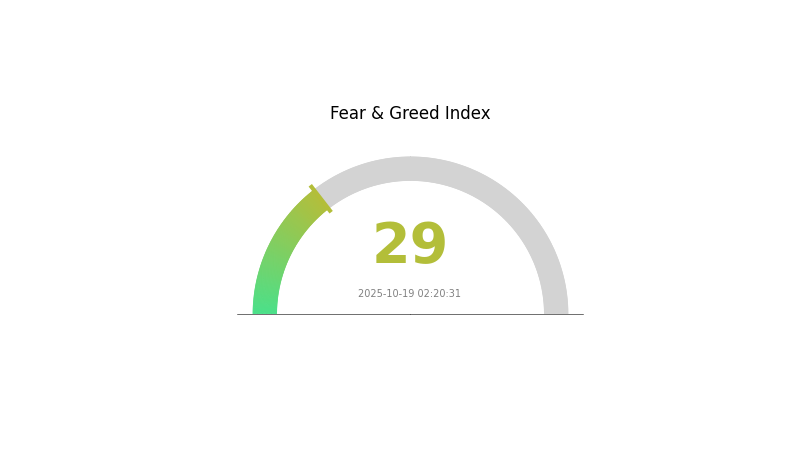

GUSD Market Sentiment Index

2025-10-19 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index sits at 29, indicating a state of fear. This suggests investors are hesitant and risk-averse, potentially creating buying opportunities for contrarian traders. However, it's crucial to conduct thorough research and exercise caution in such market conditions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results. Stay informed and consider diversifying your portfolio to manage risk effectively.

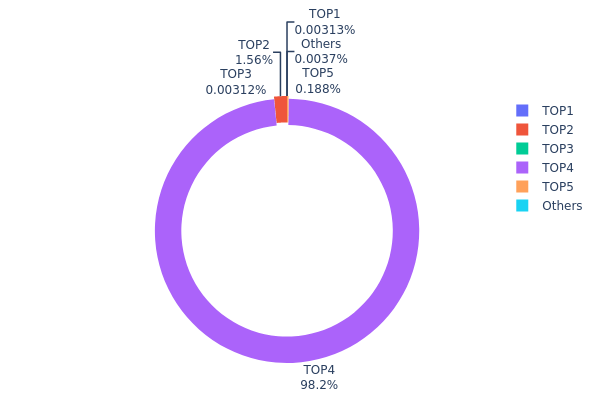

GUSD Holdings Distribution

The address holdings distribution data for GUSD reveals a highly concentrated ownership structure. The top address, 0xc882...84f071, holds an overwhelming 98.23% of the total GUSD supply, accounting for 314,367.72K tokens. This extreme concentration indicates a significant centralization of control over the GUSD token supply.

The second-largest holder, address 0x843a...e313e2, possesses 1.56% of the total supply, while the remaining addresses hold negligible amounts. This distribution pattern suggests a potential vulnerability in the market structure, as a single entity could exert substantial influence over the token's supply and, consequently, its price dynamics. Such concentration may lead to increased volatility and susceptibility to market manipulation, potentially undermining the token's stability and investor confidence.

From a market perspective, this high concentration of GUSD holdings reflects a low degree of decentralization and raises concerns about the token's on-chain structural stability. It may also impact liquidity and create challenges for broader adoption and usage of GUSD in decentralized finance applications.

Click to view the current GUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc553...c8f9dc | 10.00K | 0.00% |

| 2 | 0x843a...e313e2 | 5000.00K | 1.56% |

| 3 | 0x54bc...f3120f | 10.00K | 0.00% |

| 4 | 0xc882...84f071 | 314367.72K | 98.23% |

| 5 | 0x0d07...b492fe | 600.44K | 0.18% |

| - | Others | 11.84K | 0.029999999999987% |

II. Key Factors Influencing GUSD's Future Price

Supply Mechanism

- Pegged Supply: GUSD is a stablecoin pegged to the US dollar, maintaining a 1:1 ratio.

- Historical Pattern: The supply of GUSD has historically been adjusted based on market demand to maintain its peg.

- Current Impact: Any significant changes in GUSD supply would likely be in response to market demand or regulatory requirements, potentially affecting its availability and adoption.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions may hold GUSD as part of their stablecoin reserves.

- Corporate Adoption: Companies in the crypto space might use GUSD for trading or treasury management.

- National Policies: Regulatory developments regarding stablecoins in the US could significantly impact GUSD's adoption and usage.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve policies on interest rates and inflation could affect the demand for USD-pegged stablecoins like GUSD.

- Inflation Hedge Properties: As a USD-pegged stablecoin, GUSD's value relative to other cryptocurrencies may be influenced by inflation trends.

- Geopolitical Factors: Global economic uncertainties might drive demand for stable assets, potentially including GUSD.

Technical Development and Ecosystem Building

- Blockchain Upgrades: Any improvements to the Ethereum network, on which GUSD is based, could impact transaction speeds and costs.

- Ecosystem Applications: Integration of GUSD into DeFi platforms and payment systems could expand its utility and demand.

III. GUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.98-$1.00

- Neutral prediction: $0.99-$1.01

- Optimistic prediction: $1.00-$1.02 (requires increased adoption of GUSD in DeFi platforms)

2027-2028 Outlook

- Market phase expectation: Potential growth phase as stablecoin usage expands

- Price range forecast:

- 2027: $0.99-$1.01

- 2028: $0.99-$1.01

- Key catalysts: Integration with more blockchain networks, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $0.99-$1.01 (assuming continued stability and market trust)

- Optimistic scenario: $1.00-$1.02 (assuming widespread adoption in cross-border transactions)

- Transformative scenario: $1.00-$1.03 (assuming GUSD becomes a leading stablecoin in the crypto ecosystem)

- 2030-12-31: GUSD $1.01 (potential slight premium due to increased demand)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. GUSD Professional Investment Strategies and Risk Management

GUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational suggestions:

- Regularly stake USDT/USDC to mint GUSD

- Reinvest daily yields to compound returns

- Store GUSD in secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought or oversold conditions

- Key points for swing trading:

- Set strict stop-loss and take-profit levels

- Monitor Gate ecosystem developments for potential price impacts

GUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate funds across various stablecoins and yield-bearing assets

- Regular rebalancing: Adjust portfolio based on market conditions and risk tolerance

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage option: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for GUSD

GUSD Market Risks

- Volatility in underlying assets: Changes in Gate ecosystem revenue or RWA performance

- Liquidity risk: Potential imbalances in minting and redemption during market stress

- Yield competition: Other stablecoins or DeFi protocols offering higher returns

GUSD Regulatory Risks

- Stablecoin regulations: Potential new rules affecting GUSD's operations

- Cross-border restrictions: Limitations on GUSD usage in certain jurisdictions

- Taxation uncertainties: Evolving tax treatment of stablecoin yields

GUSD Technical Risks

- Smart contract vulnerabilities: Potential exploits in the GUSD minting/redemption mechanism

- Oracle failures: Inaccurate price feeds affecting GUSD's peg

- Network congestion: Delays in minting or redemption during high-traffic periods

VI. Conclusion and Action Recommendations

GUSD Investment Value Assessment

GUSD offers a unique blend of stability and yield potential, backed by Gate's ecosystem and real-world assets. While it provides consistent returns, investors should be aware of regulatory uncertainties and market risks associated with stablecoins.

GUSD Investment Recommendations

✅ Beginners: Start with a small allocation to understand the product ✅ Experienced investors: Consider GUSD as part of a diversified stablecoin portfolio ✅ Institutional investors: Explore GUSD for treasury management and yield optimization

GUSD Participation Methods

- Direct minting: Stake USDT/USDC on Gate.com to mint GUSD

- Secondary market trading: Buy GUSD on Gate.com's spot market

- Yield farming: Utilize GUSD in Gate.com's DeFi ecosystem for additional returns

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GUSD a good investment?

Yes, GUSD is a promising investment. As a stablecoin, it offers stability and potential for steady returns in the volatile crypto market.

Is Gemini Dollar a good investment?

Yes, Gemini Dollar (GUSD) is a promising investment. As a stablecoin pegged to the US dollar, it offers stability and potential for steady returns in the volatile crypto market.

How much will 1 Dogecoin be worth in 2025?

Based on current trends and market analysis, 1 Dogecoin could be worth approximately $0.50 to $0.75 in 2025, showing significant growth potential for this popular cryptocurrency.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

Share

Content