2025 ATH Price Prediction: Bitcoin Could Surge to $250,000 Amid Global Economic Shifts

Introduction: ATH's Market Position and Investment Value

Aethir (ATH), as a revolutionary cloud computing infrastructure platform, has achieved significant milestones since its inception. As of 2025, Aethir's market capitalization has reached $450,956,301, with a circulating supply of approximately 14,234,731,752 tokens, and a price hovering around $0.03168. This asset, hailed as the "GPU Utilization Optimizer," is playing an increasingly crucial role in artificial intelligence (AI), machine learning (ML), and cloud gaming.

This article will comprehensively analyze Aethir's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ATH Price History Review and Current Market Status

ATH Historical Price Evolution

- 2024: ATH reached its all-time high of $0.14724 on June 12, marking a significant milestone for the project

- 2025: Market sentiment shifted, leading to a price decline to the all-time low of $0.0225 on October 10

- 2025: Volatile market cycle, with price fluctuating between the high and low points throughout the year

ATH Current Market Situation

As of October 17, 2025, ATH is trading at $0.03168, representing a 24-hour decline of 11.24%. The current price is 78.49% below its all-time high and 40.80% above its all-time low. With a circulating supply of 14,234,731,752 ATH tokens, the market capitalization stands at $450,956,301.90. The 24-hour trading volume is $3,932,444.61, indicating moderate market activity. ATH has experienced significant downward pressure in recent periods, with 7-day and 30-day price changes of -40.58% and -51.01% respectively. The current market sentiment, as reflected by the VIX index of 28, suggests a state of fear among investors.

Click to view the current ATH market price

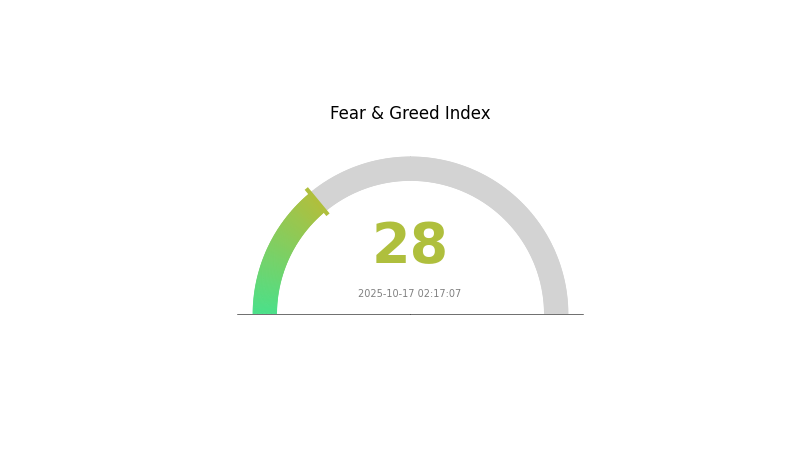

ATH Market Sentiment Indicator

2025-10-17 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 28, indicating a state of fear. This suggests investors are hesitant and potentially seeking safer assets. During such periods, some traders view it as an opportunity to accumulate, following the adage "be greedy when others are fearful." However, it's crucial to conduct thorough research and manage risks carefully in this volatile market environment.

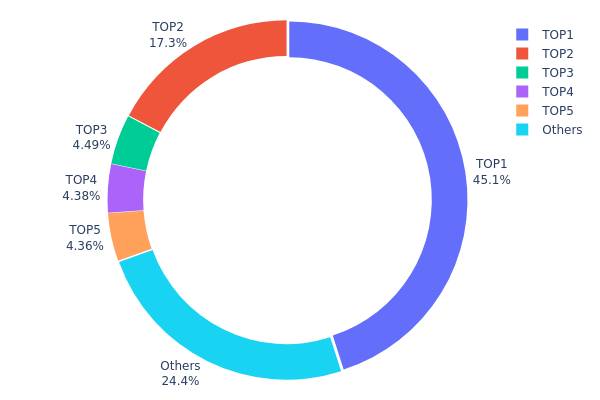

ATH Holding Distribution

The address holding distribution data reveals a highly concentrated ownership structure for ATH tokens. The top address holds a significant 45.06% of the total supply, while the top 5 addresses collectively control 75.54% of all tokens. This level of concentration raises concerns about centralization and potential market manipulation.

Such a concentrated distribution can lead to increased price volatility and susceptibility to large-scale sell-offs. The dominance of a few major holders may also impact governance decisions if ATH employs a token-based voting system. However, it's worth noting that 24.46% of tokens are distributed among other addresses, which provides some level of decentralization.

This holding pattern suggests that ATH's market structure is currently at risk of being influenced by a small number of major players. While this concentration might offer short-term stability, it could pose challenges for long-term sustainability and broader adoption of the token ecosystem.

Click to view the current ATH Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf9d9...6336b6 | 18926335.27K | 45.06% |

| 2 | 0xa02b...8d8bbe | 7259549.48K | 17.28% |

| 3 | 0x148f...771948 | 1885411.59K | 4.48% |

| 4 | 0xbcff...3c3387 | 1837500.00K | 4.37% |

| 5 | 0x3e7e...a8c2f4 | 1829201.89K | 4.35% |

| - | Others | 10262001.78K | 24.46% |

Key Factors Affecting ATH's Future Price

Supply Mechanism

- Ethereum 2.0 Upgrade: The transition to proof-of-stake and other technical improvements are expected to significantly impact ETH's supply dynamics.

- Historical Pattern: Previous supply changes have shown a correlation with price movements.

- Current Impact: The reduced issuance rate post-upgrade may create upward pressure on ETH's price due to decreased supply inflation.

Institutional and Whale Activity

- Institutional Holdings: Major institutions like BlackRock have launched Ethereum ETFs, holding substantial amounts of ETH.

- Corporate Adoption: Companies are increasingly exploring Ethereum for blockchain applications and tokenization projects.

- Government Policies: Potential inclusion of cryptocurrencies in retirement accounts and regulatory clarity are shaping the institutional landscape.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and interest rate decisions continue to influence crypto market sentiment.

- Inflation Hedge Properties: ETH is increasingly viewed as a potential hedge against inflation, similar to Bitcoin.

- Geopolitical Factors: Global economic uncertainties and conflicts can drive interest in decentralized assets like ETH.

Technological Development and Ecosystem Growth

- Layer-2 Scaling Solutions: The rapid development of Layer-2 networks like Arbitrum and Optimism is expanding Ethereum's utility and transaction capacity.

- DeFi and NFT Growth: The expanding decentralized finance and non-fungible token ecosystems on Ethereum are driving network usage and value.

- Ecosystem Applications: Major DApps and projects built on Ethereum contribute to its overall value proposition and adoption.

III. ATH Price Predictions for 2025-2030

2025 Outlook

- Conservative prediction: $0.03001 - $0.03159

- Neutral prediction: $0.03159 - $0.04000

- Optimistic prediction: $0.04000 - $0.04517 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range predictions:

- 2027: $0.02487 - $0.04477

- 2028: $0.02544 - $0.04915

- Key catalysts: Market adoption, technological advancements, regulatory clarity

2030 Long-term Outlook

- Base scenario: $0.04797 - $0.05500 (assuming steady market growth)

- Optimistic scenario: $0.05500 - $0.05949 (assuming strong market performance)

- Transformative scenario: $0.05949 - $0.06500 (assuming breakthrough technological adoption)

- 2030-12-31: ATH $0.05949 (potential peak based on projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04517 | 0.03159 | 0.03001 | 0 |

| 2026 | 0.04452 | 0.03838 | 0.03301 | 21 |

| 2027 | 0.04477 | 0.04145 | 0.02487 | 30 |

| 2028 | 0.04915 | 0.04311 | 0.02544 | 36 |

| 2029 | 0.04982 | 0.04613 | 0.03967 | 45 |

| 2030 | 0.05949 | 0.04797 | 0.02734 | 51 |

IV. Professional Investment Strategies and Risk Management for ATH

ATH Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate ATH during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor ATH's correlation with broader crypto market trends

- Set strict stop-loss orders to manage downside risk

ATH Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options trading: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use unique passwords, and regularly update software

V. Potential Risks and Challenges for ATH

ATH Market Risks

- High volatility: ATH price can experience significant short-term fluctuations

- Competition: Other cloud computing platforms may gain market share

- Market sentiment: Broader crypto market downturns could impact ATH

ATH Regulatory Risks

- Unclear regulations: Cloud computing and crypto regulations may evolve

- Cross-border operations: Different jurisdictions may impose varying rules

- Data privacy concerns: Stricter data protection laws could affect operations

ATH Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Network congestion: Ethereum network issues could affect token transfers

- Technology obsolescence: Rapid advancements in cloud computing may challenge Aethir's relevance

VI. Conclusion and Action Recommendations

ATH Investment Value Assessment

Aethir (ATH) presents a unique value proposition in the cloud computing and GPU utilization space. While it shows long-term potential in optimizing enterprise-grade GPU resources, short-term volatility and market risks should be carefully considered.

ATH Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the technology

✅ Experienced investors: Consider ATH as part of a diversified crypto portfolio

✅ Institutional investors: Conduct thorough due diligence on Aethir's technology and market position

ATH Trading Participation Methods

- Spot trading: Buy and hold ATH tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options for ATH tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can ATH reach $1?

Yes, ATH has the potential to reach $1. Current market trends and accumulation patterns suggest a possible significant price increase in the future.

What is the price prediction for Ath in 2030?

Based on current trends and analysis, the price prediction for Ath in 2030 is $0.1672. This represents a significant increase from its current value.

Is atheir a good investment?

Yes, Aethir shows promise as an investment. Projections indicate it could reach $0.03964889 by 2028, aligning with current prices. This suggests potential for growth.

What is the price prediction for Ath token in 2025?

Based on technical analysis, the Ath token is predicted to reach a minimum price of $0.0407 in 2025.

Share

Content