H vs APT: Unraveling the Complex Battle Between Human Intelligence and Advanced Persistent Threats

Introduction: Investment Comparison of H vs APT

In the cryptocurrency market, the comparison between Humanity (H) and Aptos (APT) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positioning in crypto assets.

Humanity (H): Launched recently, it has gained market recognition for its focus on Sybil-resistant blockchain and decentralized identity verification.

Aptos (APT): Introduced in 2022, it has been hailed as a high-performance PoS Layer 1 project, aiming to deliver a secure and scalable blockchain.

This article will comprehensively analyze the investment value comparison between H and APT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

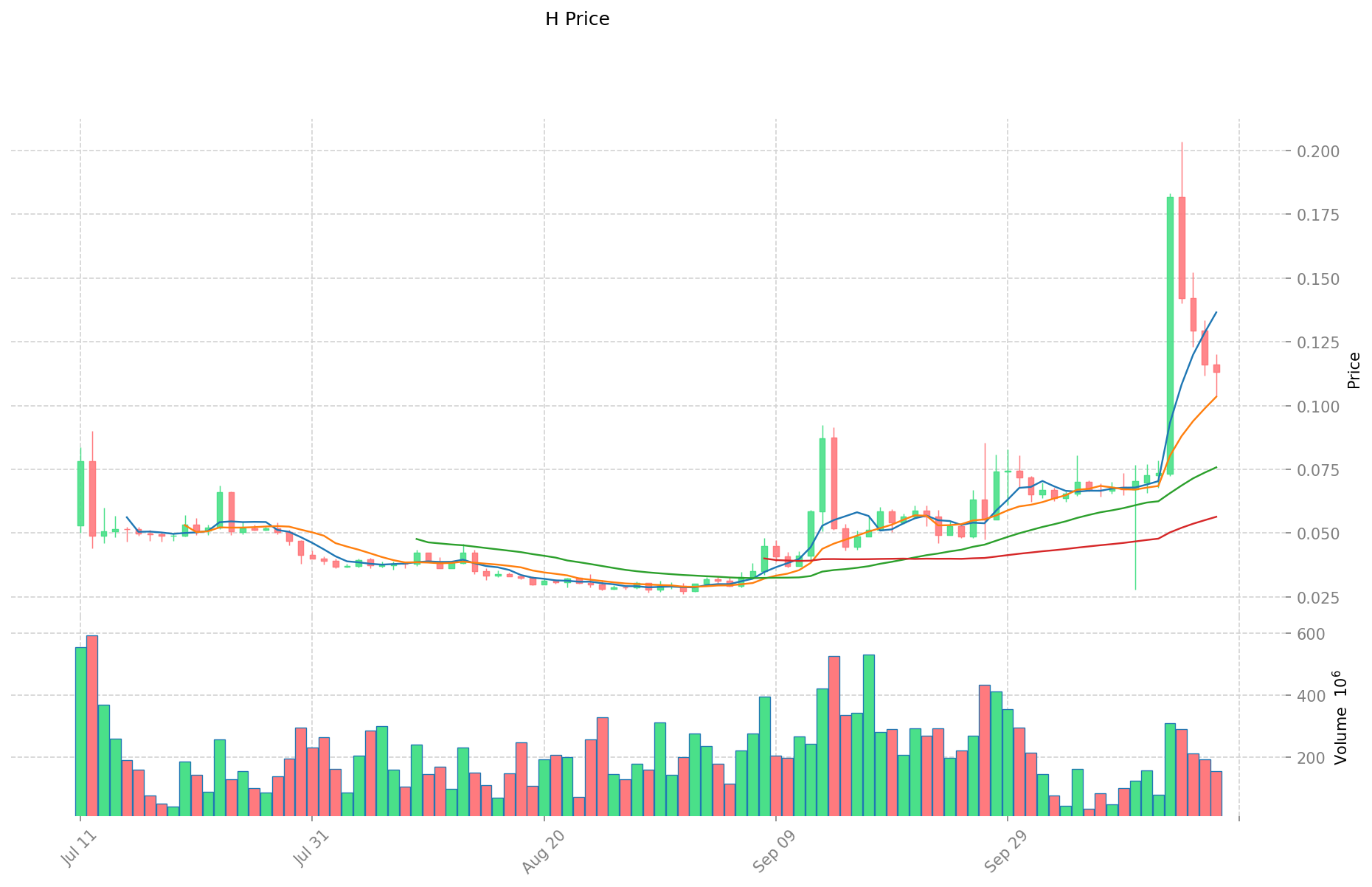

H (Humanity) and APT (Aptos) Historical Price Trends

- 2025: H reached its all-time high of $0.20354 on October 14, 2025, showing significant growth.

- 2025: APT hit its all-time low of $2.8 on October 11, 2025, experiencing a substantial decline.

- Comparative analysis: In the recent market cycle, H has risen from its low of $0.01781 to its current price of $0.11281, while APT has fallen from its all-time high of $19.92 to its current price of $3.192.

Current Market Situation (2025-10-18)

- H current price: $0.11281

- APT current price: $3.192

- 24-hour trading volume: $17,277,913.86 (H) vs $3,412,983.72 (APT)

- Market Sentiment Index (Fear & Greed Index): 23 (Extreme Fear)

Click to view real-time prices:

- View H current price Market Price

- View APT current price Market Price

II. Core Factors Affecting Investment Value of H vs APT

Supply Mechanism Comparison (Tokenomics)

- H: Supply capped at 1 billion tokens, with 50% allocated to the community treasury and 10% to the core team, creating a controlled distribution model

- APT: Total supply of 1 billion tokens with distribution across community (51.02%), core contributors (19%), investors (16.5%), and foundation (13.48%)

- 📌 Historical pattern: Capped supply tokens tend to create scarcity value when demand increases, potentially leading to price appreciation cycles for both assets.

Institutional Adoption and Market Applications

- Institutional holdings: APT has attracted significant venture capital backing from firms like a16z, while H has been building institutional partnerships more gradually

- Enterprise adoption: APT's Move programming language offers enhanced security features attractive to enterprise applications requiring smart contracts, while H focuses on cross-chain interoperability use cases

- National policies: Both tokens face varying regulatory approaches across jurisdictions, with neither having achieved clear regulatory advantages in major markets

Technical Development and Ecosystem Building

- H technical upgrades: Focuses on cross-chain composability and privacy features

- APT technical development: Leverages the Move programming language for enhanced security and Layer 1 performance optimizations

- Ecosystem comparison: APT has built a growing ecosystem spanning DeFi, NFTs and gaming applications, while H has prioritized cross-chain interoperability and privacy solutions

Macroeconomic and Market Cycles

- Performance in inflationary environments: Both assets remain relatively untested through complete economic cycles as newer tokens

- Macroeconomic monetary policy: Interest rate environments affect both tokens similarly to other crypto assets, with potential for increased volatility during Federal Reserve policy shifts

- Geopolitical factors: Cross-border transaction requirements may benefit both assets as alternatives to traditional financial systems in certain regions

III. 2025-2030 Price Prediction: H vs APT

Short-term Prediction (2025)

- H: Conservative $0.083-$0.112 | Optimistic $0.112-$0.140

- APT: Conservative $2.035-$3.180 | Optimistic $3.180-$3.498

Mid-term Prediction (2027)

- H may enter a growth phase, with an estimated price range of $0.107-$0.189

- APT may enter a growth phase, with an estimated price range of $2.882-$5.139

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- H: Base scenario $0.187-$0.211 | Optimistic scenario $0.211-$0.310

- APT: Base scenario $2.421-$4.747 | Optimistic scenario $4.747-$5.982

Disclaimer: This analysis is based on historical data and current market conditions. Cryptocurrency markets are highly volatile and unpredictable. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

H:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.1403125 | 0.11225 | 0.083065 | 0 |

| 2026 | 0.1881590625 | 0.12628125 | 0.10607625 | 11 |

| 2027 | 0.1886641875 | 0.15722015625 | 0.10690970625 | 39 |

| 2028 | 0.20753060625 | 0.172942171875 | 0.089929929375 | 53 |

| 2029 | 0.23208839465625 | 0.1902363890625 | 0.127458380671875 | 68 |

| 2030 | 0.310408716033281 | 0.211162391859375 | 0.187934528754843 | 87 |

APT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.498 | 3.18 | 2.0352 | 0 |

| 2026 | 3.60612 | 3.339 | 1.83645 | 4 |

| 2027 | 5.1393888 | 3.47256 | 2.8822248 | 8 |

| 2028 | 4.779631584 | 4.3059744 | 2.79888336 | 34 |

| 2029 | 4.95165526128 | 4.542802992 | 3.27081815424 | 42 |

| 2030 | 5.9815086995664 | 4.74722912664 | 2.4210868545864 | 48 |

IV. Investment Strategy Comparison: H vs APT

Long-term vs Short-term Investment Strategies

- H: Suitable for investors focused on cross-chain interoperability and privacy solutions

- APT: Suitable for investors interested in high-performance Layer 1 platforms and DeFi ecosystem growth

Risk Management and Asset Allocation

- Conservative investors: H: 30% vs APT: 70%

- Aggressive investors: H: 60% vs APT: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- H: Relatively new project with potential for high volatility

- APT: Increased competition in the Layer 1 space

Technical Risks

- H: Scalability, network stability

- APT: Smart contract vulnerabilities, potential Move language limitations

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with potential for stricter oversight on Layer 1 platforms like APT

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- H advantages: Focus on cross-chain interoperability, privacy features, and controlled token distribution

- APT advantages: Established ecosystem, Move language security features, and significant institutional backing

✅ Investment Advice:

- New investors: Consider a balanced approach with a slight preference for APT due to its more established ecosystem

- Experienced investors: Explore a higher allocation to H for potential growth, while maintaining APT exposure

- Institutional investors: Evaluate both assets based on specific use cases and long-term ecosystem development potential

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between H and APT in terms of their focus and technology? A: H focuses on Sybil-resistant blockchain and decentralized identity verification, with an emphasis on cross-chain interoperability and privacy features. APT, on the other hand, is a high-performance PoS Layer 1 project that utilizes the Move programming language for enhanced security and scalability.

Q2: How do the supply mechanisms of H and APT compare? A: H has a supply capped at 1 billion tokens, with 50% allocated to the community treasury and 10% to the core team. APT also has a total supply of 1 billion tokens, distributed across community (51.02%), core contributors (19%), investors (16.5%), and foundation (13.48%).

Q3: What are the current market prices and trends for H and APT? A: As of 2025-10-18, H is priced at $0.11281 and has shown significant growth from its low of $0.01781. APT is priced at $3.192 and has experienced a decline from its all-time high of $19.92.

Q4: How do institutional adoption and market applications differ between H and APT? A: APT has attracted significant venture capital backing from firms like a16z, while H has been building institutional partnerships more gradually. APT's Move programming language offers enhanced security features attractive to enterprise applications, while H focuses on cross-chain interoperability use cases.

Q5: What are the long-term price predictions for H and APT? A: For 2030, H is predicted to reach $0.187-$0.211 in the base scenario and $0.211-$0.310 in the optimistic scenario. APT is predicted to reach $2.421-$4.747 in the base scenario and $4.747-$5.982 in the optimistic scenario.

Q6: How should investors allocate their assets between H and APT? A: Conservative investors might consider allocating 30% to H and 70% to APT, while aggressive investors might allocate 60% to H and 40% to APT. The specific allocation should be based on individual risk tolerance and investment goals.

Q7: What are the main risks associated with investing in H and APT? A: For H, risks include high volatility due to being a relatively new project, as well as potential scalability and network stability issues. APT faces risks from increased competition in the Layer 1 space and potential smart contract vulnerabilities. Both tokens may be impacted by evolving regulatory policies.

Share

Content